Laws of Congress in Regard to Taxes, Currency and Conscription, Passed February 1864:

Electronic Edition.

Confederate States of America

Funding from the Institute of Museum and Library

Services

supported the electronic publication of this title.

Text scanned (OCR) by

Hong Zeng

Images scanned by

Hong Zeng

Text encoded by

Ellen Decker and Joshua G. McKim

First edition, 2001

ca. 100K

Academic Affairs Library, UNC-CH

University of North Carolina at Chapel Hill,

2001.

Source Description:

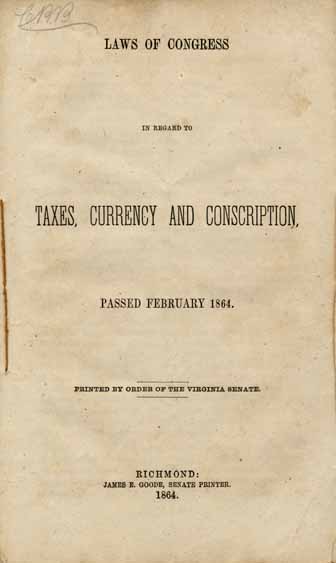

(title page) Laws of Congress in Regard to Taxes, Currency and Conscription, Passed February 1864.

35p.

Richmond:

James E. Goode, Senate Printer

1864

Call number 35conf. (Rare Book Collection, University of North Carolina at Chapel Hill)

The electronic edition is a part of the UNC-CH

digitization project, Documenting the American South.

This electronic edition has been created by Optical

Character Recognition (OCR). OCR-ed text has been compared against the

original document and corrected. The text has been encoded using the

recommendations for Level 4 of the TEI in Libraries Guidelines.

Original grammar, punctuation, and spelling have been preserved. Encountered

typographical errors have been preserved, and appear in red type.

Any hyphens occurring in line breaks have been

removed, and the trailing part of a word has been joined to

the preceding line.

All quotation marks and em dashes have been transcribed as

entity references.

All double right and left quotation marks are encoded as " and "

respectively.

All em dashes are encoded as --

Indentation in lines has not been preserved.

Spell-check and verification made against printed text using Author/Editor (SoftQuad) and Microsoft Word spell check programs.

Languages Used:

- English

- Latin

LC Subject Headings:

- Currency question -- Confederate States of America.

- Draft -- Law and legislation -- Confederate States of America.

- Law -- Confederate States of America.

- Money -- Law and legislation -- Confederate States of America.

- Taxation -- Law and legislation -- Confederate States of America.

Revision History:

- 2001-03-27,

Celine Noel and Wanda Gunther

revised TEIHeader and created catalog record for the electronic edition.

-

2001-02-01,

Joshua G. McKim

finished TEI-conformant encoding and final proofing.

-

2000-11-21,

Ellen Decker

finished TEI/SGML encoding

- 2000-11-10,

Hong Zeng

finished scanning (OCR) and proofing.

LAWS OF CONGRESS

IN REGARD TO

TAXES, CURRENCY AND CONSCRIPTION,

PASSED FEBRUARY 1864.

PRINTED BY ORDER OF THE VIRGINIA SENATE.

RICHMOND:

JAMES E. GOODE, SENATE PRINTER.

1864.

Page 3

CONFEDERATE TAX LAW.

An act to amend an act entitled "An act to lay taxes for the common defence and carry on the government of the Confederate States," approved April 24, 1863.

The congress of the Confederate States of America do enact, That an act entitled an act to lay taxes for the common defence and carry on the government of the Confederate States, approved April 24, 1863, be, and the same is hereby amended, so as to read as follows:

SEC. 1. That every person engaged, or intending to engage, in any business named in the fourth section of this act, shall, within sixty days after the passage of this act, or at the time of beginning business, and on the first day of January in each year thereafter, register with the district collector, in such form as the commissioner of taxes shall prescribe, a true account of the name and residence of each person, firm or corporation engaged or interested in the business, with a statement of the time for which, and the place and manner in which, the same is to be conducted, and of all other facts going to ascertain the amount of tax upon such business, for the past or the future, according to the provisions of this act. At the time of such registry, there shall be paid to the collector the specific tax for the year ending on the next thirty-first of December, and such other tax as may be due upon sales or receipts in such business, at the time of such registry, as herein provided; and the collector shall give to the person making such registry a copy thereof, with a receipt for the amount of the tax then paid.

SEC. 2. That any person failing to make the registry, and to pay the tax required by the preceding section, shall, in addition to all other taxes upon his business imposed by this act, pay double the amount of the specific tax on such business, and a like sum for every thirty days of such failure.

Page 4

SEC. 3. That except where herein otherwise provided, there shall be a separate registry and tax for each business mentioned in the fourth section of this act, and for each place of conducting the same, but no tax shall be required for the mere storage of goods at a place other than the registered place of business. Upon every change in the place of conducting a registered business there shall be a new registry, but no additional tax shall be required. Upon the death of any person conducting a business, registered and taxed as herein required, or upon the transfer of the business to another, the business shall not be subjected to any additional tax, but there shall be a new registry in the name of the person authorized by law to continue the business.

SEC. 4. That upon each trade, business or occupation hereinafter named, the following taxes shall be levied and paid for the year ending on the thirty-first of December 1863, and for each and every year thereafter, viz :

I. Bankers shall pay five hundred dollars. Every person shall be deemed a banker within the meaning of this act, who keeps a place of business where credits are opened in favor of any person, firm or corporation, by the deposit or collection of money or currency, and by whom the same, or any part thereof, shall be paid out or remitted, upon the draft, check or order of such creditor; but not to include any bank legally authorized to issue notes as circulation, nor agents for the sale of merchandise for account of producers or manufacturers.

II. Auctioneers shall pay fifty dollars and two and-a-half per centum on the gross amount of sales made: provided, however, that on all sales at auction of stock or securities for money, the tax shall be one-fourth of one per centum on the gross amount of sales. Every person shall be deemed an auctioneer, within the meaning of this act, whose occupation it is to offer property for sale, to the highest or best bidder, at public outcry. The tax upon the auctioneers shall be deemed a tax upon the personal privilege, to be paid by each individual engaged in the business, and without regard to the place at which the same is conducted. No tax shall be required upon auction sales made for dealers in a business registered and taxed, and at their place of business, upon official sales at auction, made by judicial or executive officers, or by personal representatives, guardians or committees.

III. Wholesale dealers in liquors, of any and every description, including distilled spirits, fermented liquors and wines of all kinds, shall

Page 5

pay two hundred dollars and five per centum on the gross amount of sales made. Every person, other than the distiller or brewer, who shall sell, or offer for sale, any such liquors or wines, in quantities of more than three gallons at one time to the same purchaser, shall be regarded as a wholesale dealer in liquors within the meaning of this act. All persons who shall sell, or offer for sale, any such liquors or wines, in quantities less than three gallons at one time to the same person, shall be regarded as a retail dealer in liquors.

IV. Retail dealers in liquors, including distilled spirits, fermented liquors, and wines of every description, shall pay one hundred dollars and ten per centum on the gross amount of all sales made.

V. Retail dealers, whose quarterly sales shall exceed one hundred dollars, and shall be less than five hundred dollars, shall pay twenty-five dollars and two and-a-half per centum on the gross amount of sales made; and where quarterly sales exceed five hundred dollars, the specific tax shall be fifty dollars and two and-a-half per centum on the gross amount of sales made. Every person whose business or occupation it is to sell, or offer to sell, groceries or any goods, wares, merchandise, or other things of foreign or domestic production, in less quantities than a whole original piece or package at one time to the same person, (not including wines, spirituous or malt liquors,) shall be regarded as a retail dealer under this act: provided, however, that any mechanic who shall sell only the products of the labor of himself and his own family, shall be exempt from this tax.

VI. Wholesale dealers shall pay two hundred dollars and two and-a-half per centum on the gross amount of all sales made. Every person whose business or occupation it is to sell, or offer to sell, groceries, or any goods, wares or merchandise of foreign or domestic production, by one or more original packages or pieces at one time, to the same purchaser, not including wines, spirituous or malt liquors; and every person whose business it is to sell, or offer to sell, slaves, shall be deemed as a wholesale dealer under this act; but having been registered as a wholesale dealer, such person may also sell as aforesaid as a retailer: provided, that contractors working for and selling their own products exclusively to the Confederate States, to an amount not exceeding five thousand dollars a year, and such dealers as sell exclusively to consumers, and not to others to sell again, shall not be regarded as wholesale, but as retail dealers.

Page 6

VII. Pawn brokers shall pay two hundred dollars. Every person whose business or occupation it is to take or receive by way of pledge, favor or exchange, any goods, wares or merchandise of any kind of personal property whatever, for the repayment or security of money lent thereon, shall be deemed a pawn broker under this act.

VIII. Distillers shall pay two hundred dollars and twenty per centum on the gross amount of all sales made; and also twenty per centum on the value of all liquors distilled for any other person, and the tax on distillers shall be a lien on the still or stills used, and upon the other fixtures and articles for carrying on the business, and shall have priority over all other liens or claims. Every person or co-partnership who distils or manufactures spirituous liquors for others, or for sale, shall be deemed a distiller under this act: provided, however, that distillers of fruit, for ninety days or less, shall pay sixty dollars, and also fifty cents per gallon on the first ten gallons, and two dollars per gallon on all spirits distilled beyond that quantity.

IX. Brewers shall pay one hundred dollars, and two and-a-half per centum on the gross amount of sales made. Every person who manufactures fermented liquors, of any name or description for sale, from malt, wholly or in part, shall be deemed a brewer under this act.

X. Hotels, inns, taverns and eating houses shall be classified and rated according to the yearly rental, or if not rented, according to the estimated value of the house or property occupied, or intended to be occupied, as a hotel, inn, tavern or eating house, as follows, viz: In cases where the actual or estimated rent shall amount to ten thousand dollars or more, they shall constitute the first class, and pay an annual sum of five hundred dollars. In cases where said rent shall be five thousand, and less than ten thousand dollars, they shall constitute the second class, and pay an annual sum of three hundred dollars. And in cases where said rent shall be two thousand five hundred dollars, and less than five thousand dollars, they shall constitute the third class, and pay an annual sum of two hundred dollars. In cases where said rent shall be one thousand dollars, and less than twenty-five hundred dollars, they shall constitute the fourth class, and pay an annual sum of one hundred dollars. And in cases where said rent shall be less than one thousand dollars, they shall constitute the fifth class, and pay an annual sum of thirty dollars. Every place where food and lodgings, or lodgings only, are provided for travelers, sojourners, or boarders, in view of payment therefor, the income or receipts from which amount to five hundred

Page 7

dollars from that source, shall be regarded a hotel, inn or tavern, under this act.

XI. That every place where food or refreshments of any kind are provided for casual visitors, and sold for consumption therein, and every boarding house in which there shall be six boarders or more, shall be deemed an eating house under this act.

XII. Brokers shall pay two hundred dollars. Any person whose business it is to purchase and sell stocks, coined money, bank notes, or other securities for themselves or others; or who deals in exchanges relating to money, shall be deemed a broker under this act.

XIII. Commercial brokers, or commission merchants, shall pay two hundred dollars and two and-a-half per centum upon all sales made. Any person or firm, except one registered as a wholesale dealer or a banker, whose business it is, as the agent of others, to purchase or sell goods, or seek orders therefor, in original or unbroken packages, or produce consigned by others than the producers, to manage business matters for the owners of vessels, or for the shippers or consigners of goods, or whose business it is to purchase, rent, hire or sell real estate or negroes, shall be deemed a commercial broker or commission merchant, under this act.

XIV. Tobacconists shall pay fifty dollars, and two and-a-half per centum on the gross amount of sales. Any person whose business it is to sell, at retail, segars, snuff or tobacco, in any form, shall be deemed a tobacconist under this act; but registered wholesale and retail dealers shall not be taxed as tobacconists.

XV. Theatres shall pay five hundred dollars, and five per centum on all receipts, which tax shall be paid by the owner of the building. Every edifice used for the purpose of dramatic representations, plays or performances, and not including halls rented or used occasionally for concerts or theatrical representations, shall be regarded as a theatre under this act. Each circus shall pay one hundred dollars, and a tax of ten dollars for each exhibition; which tax shall be paid by the manager thereof. Every building, tent, or space, or area, where feats of horsemanship or accrobatic sports are exhibited, shall be regarded as a circus under this act. Jugglers, and other persons exhibiting shows, shall pay fifty dollars. Every person who performs by sleight of hand shall be regarded as a juggler under this act: provided, that no registry made in one state shall be held to authorize exhibitions in another

Page 8

state, and but one registry shall be required under this act to authorize exhibitions in any one state.

XVI. Bowling alleys and billiard rooms shall pay forty dollars for each alley or billiard table registered, which tax shall be paid by the owner thereof. Every place or building where bowls are thrown, or billiards played, and open to the public with or without price, shall be regarded as a bowling alley or billiard room, respectively, under this act.

XVII. Livery stable keepers shall pay fifty dollars. Any person whose occupation or business it is to keep horses for hire or to let, shall be regarded as a livery stable keeper under this act.

XVIII. Cattle brokers shall pay the sum of fifty dollars, and two and-a-half per centum on the gross amount of sales made. Any person whose business it is to buy and sell and deal in cattle, horses, hogs or sheep, shall be considered a cattle broker.

XIX. Butchers and bakers shall pay the sum of fifty dollars and one per centum on the gross amount of sales made. Any person whose business it is to butcher and sell, or offer for sale in open market, or otherwise, the flesh of cattle, hogs or sheep, shall be deemed a butcher under this act; and any person whose business it is to bake and sell, or offer for sale bread, shall be deemed a baker under this act.

XX. Peddlers shall pay fifty dollars and two and-a-half per centum on the gross sales. Any person, except persons engaged in peddling exclusively periodicals, books, newspapers, (published in the Confederate States,) bibles or religious tracts, who sells or offers to sell at retail, goods, wares or other commodities, travelling with his goods from place to place, in the streets, or through different parts of the country, shall be deemed a peddler under this act: provided, that any peddler who sells or offers to sell dry goods, foreign or domestic, by one or more original pieces or packages at one time, and to the same person or persons as aforesaid, shall pay one hundred dollars and two and-a-half per centum on the gross sales; and any person who peddles jewelry, shall pay fifty dollars and two and-a-half per centum on the gross sales. The tax upon peddlers shall be deemed a tax on the personal privilege, to be paid by each individual engaged in the business, without regard to the place at which the same is conducted.

XXI. Apothecaries shall pay fifty dollars and two and-a-half per centum on the gross amount of sales made. Every person who keeps a

Page 9

shop or building where medicines are compounded or prepared according to prescriptions of physicians, and sold, shall be regarded as an apothecary under this act.

XXII. Photographers shall pay the sum of fifty dollars and two and-a-half per centum on the gross amount of sales made. Any person or persons who make for sale photographs, ambrotypes, daguerreotypes or pictures on glass, metals, paper or other material, by the action of light, shall be regarded a photographer under this act.

XXIII. Lawyers, actually engaged in practice, shall pay fifty dollars. Every person whose business it is, for fee or reward, to prosecute or defend causes in any court of record, or other judicial tribunal of the Confederate States, or of any state, or give advice in relation to causes or matters pending therein, shall be deemed a lawyer within the meaning of this act.

XXIV. Physicians, surgeons and dentists, actually engaged in the practice, shall pay fifty dollars. Every person whose business it is, for fee or reward, to prescribe remedies or perform surgical operations for the cure of any bodily disease or ailing, shall be deemed a physician, surgeon or dentist, within the meaning of this act, as the case may be; and the provisions of paragraph number twenty-one shall not extend to physicians who keep on hand medicines solely for the purpose of making up their own prescriptions for their own patients. The tax upon lawyers, physicians, surgeons and dentists, shall be deemed a tax upon the personal privilege, to be paid by each individual in the business and without regard to the place at which the same is conducted: provided, that the provisions of this act shall not apply to physicians and surgeons exclusively engaged in the confederate service.

XXV. Confectioners shall pay fifty dollars and two and-a-half per centum on the gross amount of sales. Every person who sells at retail, confectionary, sweet-meats, comfits or other confects, in any building, shall be regarded as a confectioner under this act.

SEC. 5. That every person registered and taxed upon the gross amount of sales as aforesaid, shall be required on the first day of July 1863, to make a list or return to the assessor of the district, of the gross amount of such sales as aforesaid, viz: from the passage of this act to the thirtieth day of June 1863, inclusive, and at the end of every three months, or within twenty days thereafter, after the said first day of July 1863, make a list or return to the assessor of the district of the

Page 10

gross amount of such sales made as aforesaid, with the amount of tax which has accrued or should accrue thereon, which list shall have annexed thereto a declaration under oath or affirmation, in form or manner as may be prescribed by the commissioner of taxes, that the same is true and correct, and shall, within such time as the collector may designate, by public notice, (which time shall not be less than ten nor more than thirty days from the date of such notice,) pay to the collector the amount of tax thereupon, as aforesaid, and in default thereof, shall pay a penalty in double the amount of the tax.

SEC. 6. That upon the salaries of all salaried persons, serving in any capacity whatever, except upon the salaries of persons in the military or naval service, there shall be levied and collected a tax of one per centum on the gross amount of such salary, when not exceeding fifteen hundred dollars, and two per centum upon any excess over that amount, to be levied and collected at the end of each year, in the manner prescribed for other taxes enumerated in this act: provided, that no taxes shall be imposed by virtue of this act on the salary of any person receiving a salary not exceeding one thousand dollars per annum, or at a like rate for another period of time longer or shorter.

SEC. 7. That the secretary of the treasury shall cause to be assessed and ascertained, on the first day of January next, or as soon thereafter as practicable, the income and profits derived by each person, joint stock company and corporation, from every occupation, employment or business, whether registered or not, in which they may have been engaged, and from every investment of labor, skill, property or money, and the income and profits derived from any source whatever, except salaries, during the calendar year preceding the said first day of January next; and the said income and profits shall be ascertained, assessed and taxed in the manner hereinafter prescribed:

I. If the income be derived from the rent of houses, lands, tenements, manufacturing or mining establishments, fixtures and machinery, mills, springs of salt or oil, or veins of coal, iron or other minerals, there shall be deducted from the gross amount of the annual rent a sum sufficient for the necessary annual repairs, not exceeding ten per centum on said rent, except that the rent derived from houses shall be subject to a deduction not exceeding five per centum for annual repairs.

II. If the income be derived from any manufacturing or mining business, there shall be deducted from the gross value of the products of the

Page 11

year--first, the rent of the establishment and fixtures, if actually rented and not owned by the persons prosecuting the business; second, the cost of the labor actually hired and paid for; third, the actual cost of the raw material purchased and manufactured; fourth, if the income be derived from the production of pig metal or bloom iron, from the ore, there shall be deducted the cost of labor, food and necessary repairs.

III. If the income be derived from navigating enterprises, there shall be deducted from the gross earnings, including the value of freights on goods shipped by the person running the vessel, the hire of the boat or vessel, if not owned by the person running the same, or if owned by him, a reasonable allowance for the wear and tear of the same, not exceeding ten per centum per annum, and also the cost of running the boat or vessel.

IV. If the income be derived by the taxpayer from boat or ship building, there shall be deducted from the gross receipts of his occupation, including the value of the boat or ship when finished, if built for himself, the cost of the labor actually hired and paid by himself, and the prime cost of the materials, if purchased by him.

V. If the income be derived by the taxpayer, from the sale of merchandise or any other property, real or personal, there shall be deducted from the gross amount of sales the prime cost of the property sold, including the cost of transportation, salaries of clerks actually paid and the rent of the buildings employed in the business, if hired and not owned by himself.

VI. If the income be derived by the taxpayer from any other occupation, profession, employment or business, there shall be deducted from the gross amount of fees, compensation, profits, earnings or commissions, the salaries of clerks actually paid, and the rent of the office or other building used in the business, if hired and not owned by himself, the cost of labor actually paid, and not owned by himself, and the cost of material other than machinery purchased for the use of his business, or to be converted into some other form in the course of his business, and in the case of mutual insurance companies the amount of losses paid by them during the year. The income derived from all other sources shall be subject to no deduction whatever, nor shall foreigners be subject to a tax upon any other income than that derived from property owned, or occupations or employments pursued by them within the Confederate States; and in estimating incomes there shall be included the interest, dividends, profits or other proceeds of money or credits of every description,

Page 12

on which such interest, dividends, profits or other proceeds shall have accrued for the year, whether received or not, and the value of the estimated annual rental of all dwelling houses, buildings or building lots in cities, towns or villages, occupied by the owners, or owned and not occupied or hired, and the value of the estimated annual hire of all slaves, not engaged on plantations or farms, and not employed in some business or occupations, the profits of which are taxed as income under this act. When the income shall be thus ascertained, all of those which do not exceed five hundred dollars per annum, shall be exempt from taxation. On all incomes received during the year over five hundred dollars, and not exceeding fifteen hundred dollars, a tax of five per centum shall be paid. On all incomes over fifteen hundred dollars, and less than three thousand dollars, five per centum shall be paid on the first fifteen hundred dollars and ten per centum on all excess. On all incomes of or over three thousand dollars, and less than five thousand dollars, a tax of ten per centum shall be paid. On all incomes of [or] over five thousand dollars, and less than ten thousand dollars, a tax of twelve and-a-half per centum shall be paid; and on all incomes of [or] over ten thousand dollars, a tax of fifteen per centum shall be paid. All joint stock companies and corporations shall reserve one-tenth of the annual earnings set apart for dividend and reserved fund, to be paid to the collector of the confederate tax, and the dividend then paid to the stockholder shall not be estimated as a part of his income for the purposes of this act. All persons shall give in an estimate of their income and profits derived from any other source whatever, and in so doing shall first state the gross amount of their receipts as individuals or members of a firm or partnership, and also state particularly each item for which a deduction is to be made and the amount to be deducted for it: provided, that the incomes and profits upon which the above tax is to be imposed, shall not be deemed to include the products of land, which are taxed in kind as hereinafter described: provided further, that in case the annual earnings of said joint stock companies and corporations set apart as aforesaid, shall give a profit of more than ten and less than twenty per centum upon their capital stock paid in, one-eighth of said sum so set apart shall be paid as a tax to the collector aforesaid, and in case said sum so set apart shall give a profit of more than twenty per centum on their capital stock paid in, one-sixth thereof shall be reserved and paid as aforesaid. The tax levied in this section shall be paid on the first day of January next, and on the first day of January of each year thereafter.

Page 13

SEC. 8. That if the assessor shall be dissatisfied with the statement or estimate of income and profits derived from any source whatever, other than products in kind, which the taxpayer is required to render, or with any deduction claimed by said taxpayer, he shall select one disinterested citizen of the vicinage as a referee, and the taxpayer shall select another, and the two thus selected shall call in a third, who shall investigate and determine the facts in reference to said estimates and deductions, and fix the amount on income and profits on which the taxpayer shall be assessed, and a certificate, signed by a majority of the referees, shall be conclusive as to the amount of income and profits on which the taxpayer shall be assessed: provided, that if any person shall fail or refuse to render the statement or estimate aforesaid, or shall fail or refuse to select a referee as aforesaid, the assessor shall select three referees, who shall fix the amount of income and profits on which the taxpayer shall be assessed, from the best evidence they can obtain, and a certificate signed by a majority of said referees, shall be conclusive on the taxpayer: and provided further, that in any case submitted to referees, if they, or a majority of them, shall find and certify that the statement or estimate of income and profits rendered by the taxpayer does not contain more than four-fifths of the true and real amount of his taxable income and profits, then the tax payer, in addition to the income tax on the true amount of his income and profits, ascertained and assessed by the referees, shall pay ten per centum on the amount of said income tax, and the assessor shall be entitled to one-fifth of said additional ten per centum over and above all other fees and allowances: and provided further, that the assessor may administer oaths to referees, the tax payer, and any witness before the referees, in regard to said estimate and any deduction claimed, or any fact in reference thereto, in such form as the secretary of the treasury may prescribe.

SEC. 9. On all profits made by and person, partnership or corporation, during the year eighteen hundred and sixty-two, by the purchase, within the Confederate States, and sale during the said year, of any flour, corn, bacon, pork, oats, hay, rice, salt or iron, or the manufactures of iron, sugar, molasses made of cane, leather, woolen cloths, shoes, boots, blankets and cotton cloths, a tax of ten per centum shall be levied and collected, to be paid on the first day of July next: provided that the tax imposed by this section shall not apply to purchases and sales made in the due course of the regular retail business, and shall not continue beyond the present year.

Page 14

SEC. 10. That each farmer and planter in the Confederate States, shall pay and deliver to the confederate government, of the products of the present year, one tenth of the wheat, corn, oats, rye, buckwheat or rice, Irish potatoes, and of the cured hay and fodder; also one tenth of the sugar, molasses made of cane or of sorghum, where more than thirty gallons are made, cotton, wool and tobacco; the cotton ginned and packed in some secure manner, and tobacco stripped and packed in boxes; the cotton to be delivered by him on or before the first day of March, and the tobacco on or before the first day of July, next after their production. Each farmer or planter shall deliver to the confederate government, for its use, one tenth of the peas, beans and ground peas, produced and gathered by him during the present year. As soon as each of the aforesaid crops are made ready for market, the tax assessor, in case of disagreement between him and the taxpayer, shall proceed to estimate the same, in the following manner: The assessor and taxpayer shall each select a disinterested freeholder from the vicinage, who may call in a third, in case of a difference of opinion, to settle the matter in dispute; or if the taxpayer neglects or refuses to select one such freeholder, the said assessor shall select two, who shall proceed to assess the crops as herein provided. They shall ascertain the amount of the crops, either by actual measurement or by computing the contents of the rooms or houses in which they are held; when a correct computation is practicable by such a method, and the appraisors shall then estimate, under oath, the quantity and quality of said crops, including what may have been sold or consumed by the producer, prior to said estimates, whether gathered or not, excepting from said estimates such portion of said crops as may be necessary to raise and fatten the hogs of such farmer, planter or gaazier, for pork: provided that the following persons shall be exempt from the payment of the tax in kind, imposed by this section, viz:

I. Each head of a family not worth more [than] five hundred dollars.

II. Each head of a family with minor children, not worth more than five hundred dollars for himself, and one hundred dollars for each minor living with him, and five hundred dollars in addition thereto for each minor son he has living or may have lost, or had disabled in the military or naval service.

III. Each officer, soldier or seaman, in the army or navy, or who has been discharged therefrom for wounds and is not worth more than one thousand dollars.

Page 15

IV. Each widow of any officer, soldier or seamen, who has died in the military or naval service, the widow not worth more than one thousand dollars: provided, that in all cases where the farmer or planter does not produce more than fifty bushels of Irish potatoes, two hundred bushels of corn, or twenty bushels of peas and beans, he shall not be subjecr to the tax in kind on said articles, or either of them; and the forage derived from the corn plant, shall also be exempt in all cases where the corn is not taxed in kind; neither shall any farmer or planter, who does not produce more than ten pounds of wool, or more than fifteen pounds of ginned cotton for each member of the family, be subject to said tax in kind. The tax assessor, after allowing the exemptions authorized in this section, shall assess the value of the portion of said crops to which the government is entitled, and shall give a written statement of this estimate to the collector, and a copy of the same to the producer. The said producer shall be required to deliver the wheat, corn, oats, rye, buckwheat, rice, peas, beans, cured hay and fodder, sugar, molasses of cane or sorghum, wool, thus to be paid as a tithe in kind, after they have been estimated as aforesaid, in such form and ordinary marketable condition as may be usual in the section in which they are to be delivered, within thirty days from the date of notice given by the agent of collection that he is ready to receive such produce, (except cotton and tobacco shall be delivered in the manner and at the times hereinbefore provided,) at some depot not more than twelve miles from the place of production, and it not delivered by the times and in the order stated, he shall be liable to pay five times the estimated value of the portion aforesaid, to be collected by the tax collector as hereinafter prescribed: provided the post quartermasters may direct such delivery to be made at any time within five months after the date of said estimates, under the sanction of the penalty aforesaid, and that producers shall be paid the expenses of the transportation of their tithes at the usual rates of compensation paid by the government in the state in which the delivery is made. Such delivery, when required to be made of grain in bushels, shall be made in bushels according to the government standard of weight per bushel: provided that the government shall be bound to furnish to the producer sacks for the delivery of such articles of grain as require to be put in sacks for transportation, and shall allow to the producers of molasses the cost of the barrels containing the same. The said estimates shall be conclusive evidence of the amount in money of the tax due by the producer to the government, and the collector is hereby authorized to proceed to collect the same by issuing a warrant

Page 16

of distress from his office, under his signature, in the nature of a writ of fieri facias, and by virtue of the same to seize and sell any personal property on the premises of the taxpayer or elsewhere, belonging to him, or so much thereof as may be necessary for the purpose of paying the tax, and the increase aforesaid and costs; and said sale shall be made in the manner and form, and after the notice required by the laws of the several states, for judicial sales of personal property; and the said warrant of distress may be executed by the tax collector, or any deputy appointed by him for that purpose, and the deputy executing the warrant shall be entitled to the same fees as are allowed in the respective states, to sheriffs executing writs of fieri facias; said fees to be paid as cost, by the taxpayer: provided, that in all cases where the assessor and taxpayer agree on the assessment of the crops, and the value of the portion thereof to which the government is entitled, no other assessment shall be necessary; but the estimate agreed on shall be reduced to writing, and signed by the assessor and taxpayer, and have the same force and effect as the assessment and estimate of disinterested freeholders, hereinbefore mentioned; and two copies of such assessment and estimate, thus agreed on and assigned as aforesaid, shall be made, and one delivered to the producer, and the other to the collector: and provided further, that the assessor is hereby authorized to administer oaths to the taxpayer and to witness in regard to any item of the estimates herein required to be made: and provided further, when agricultural produce in kind is paid for taxes, if payment be made by a tenant, who is bound to pay his rent in kind, the tenth part of said rent in kind shall be paid in kind by the tenant to the government, as and for the tax of the lessor on said rent; and the receipt of the government officer shall release the lessor from all obligation to include such rent in kind in his statement of income; and discharge the tenant from so much of his rent to the lessor.

SEC. 11. That every farmer, planter or grazier, or other person who slaughters hogs, shall exhibit to the assessor on or about the first of March 1864, an account of all the hogs he may have slaughtered since the passage of this act, and before that time. After the delivery of this estimate to the post quartermaster hereinafter mentioned, by the assessor, the said farmer, planter, grazier, or other person who slaughters hogs, shall deliver an equivalent for one-tenth of the same in cured bacon, at the rate of sixty pounds of bacon to the one hundred weight of pork. That on the first of November 1863, and each year thereafter, an estimate shall be made, as hereinbefore provided, of the value of all

Page 17

neat cattle, horses, mules not used in cultivation, and asses owned by each person in the Confederate States, and upon such value the said owner shall be taxed one per centum, to be paid on the first day of January next ensuing. If the grazier, planter or farmer shall have sold beeves since the passage of this act, and prior to the first day of November, the gross proceeds of such sales shall be estimated and taxed as income, after deducting therefrom the money actually paid for the purchase of such beeves, if they have been actually purchased, and the value of the corn or peas consumed by them. The estimate of these items shall be made, in case of disagreement between the assessor and taxpayer, as herein provided in other cases of income tax: provided, that no farmer, planter or grazier, or other person, who shall not slaughter more than two hundred and fifty pounds of net pork during any year, shall be subject to the bacon tithe imposed by this section; and every officer, soldier or seaman, in the military or naval service, or who may have been discharged therefrom on account of wounds, or physical disability, and any widow of such officer, soldier or seaman, or any head of a family who does not own more than two cows and calves, shall be exempt from the tax imposed by this section on neat cattle.

SEC. 12. That the secretary of war shall divide the service of the quartermaster's department into two branches--one herein denominated post quartermasters, for the collection of the articles paid for taxes in kind, and the other for distribution to the proper points for supplying the army, and for delivering cotton and tobacco to the agents of the secretary of the treasury. The tax assessor shall transfer the estimate of articles due from each person by way of a tax in kind, to the duly authorized post quartermaster, taking from the said quartermaster a receipt, which shall be filed as a voucher with the chief collector in settling his account, and a copy of this receipt shall be furnished by the chief collector to the auditor settling the post quartermaster's account as a charge against him. The post quartermaster receiving the estimate shall collect from the taxpayer the articles which it specifies, and which he is bound to pay and deliver as a tax to the confederate government. The post quartermaster shall be liable for the safe custody of the articles placed in his care, and shall account for the same by showing that after proper deductions from unavoidable loss, the residue has been delivered to the distributing agents as evidenced by their receipts. The said post quartermasters shall also state the accounts of the quartermasters receiving from him the articles delivered in payment of taxes in kind at his depot, and make a monthly report of the same to such officer as the

Page 18

secretary of war may designate: provided, that in case the post quarter-master shall be unable to collect the tax in kind specified in the estimate delivered to him as aforesaid, he shall deliver to the district tax collector said estimate as a basis for the distress warrant authorized to be issued, and take a receipt therefor, and forward the same to the chief tax collector as a credit in the statement of the accounts of said post quartermaster: provided that any partial payment said tax in kind shall be endorsed on said estimate before delivering the same to the district tax collector as aforesaid, and the receipt given to him therefor by the district tax collector, shall specify said partial payment. When the articles thus collected, through the payment of taxes in kind, have been received at the depot as aforesaid, they shall be distributed to the agents of the secretary of the treasury, if they consist of cotton or tobacco, or if they be suitable for forage or subsistence, to such places and in such manner as the secretary of war may prescribe. The wool collected under this act shall be retained by the quartermaster's department as supplies. Should the secretary of war find that some of the agricultural produce thus paid in and suitable for forage and subsistance, has been or will be deposited in places where it cannot be used either directly or indirectly for these purposes, he shall cause the same to be sold in such manner as he may prescribe, and the proceeds of such sale shall be paid into the treasury of the Confederate States. Should, however, the secretary of war notify the secretary of the treasury that it would be impracticable for him to collect or use the articles taxed in kind, or any of them to be received in certain districts or localities, then the secretary of the treasury shall proceed to collect in said district or locality the money value of said articles specified in said estimate and not required in kind, and said money value shall be due on the first day of January in each and every year, and be collected as soon thereafter as practicable; and where in districts heretofore, or which may hereafter be ascertained to be so impracticable, quartermasters or commissaries serving with troops in the field, shall have collected or may hereafter collect from producers any portion of their tax in kind, the receipts of such officers shall be held good to the producers against the collection of the money value of their tax, to the extent and value of such portions as may have been or may be hereafter collected. And where assessments in practicable localities have been made and transferred to the post quartermasters, and transportation is difficult to be obtained, the supply of grain sacks insufficient, or the amount of produce receivable is too small to justify the expenses of collection,

Page 19

post quartermasters, with the approval of the superior officers, shall be authorized to transfer the estimate to district collectors, to be collected in their money value only.

SEC. 13. That the assessors, whose duty it is under said act to estimate the taxes in kind, shall be appointed by the secretary of war, and their duties shall be the same, and the duties shall be executed in the same manner as is prescribed by sections ten, eleven and twelve of this act, in reference to the estimates and assessment of taxes in kind on agricultural products and slaughtered hogs; and there may be one assessor appointed for each practicable tax district, and he shall take the oath as assessor of taxes in kind, prescribed by section five of the act for the assessment and collection of taxes, approved May 1, 1863, which oath shall be delivered to such officer as the secretary of war may designate. And the assessors of taxes in kind shall be separate and distinct from the assessors of money tax, and shall be subject to the exclusive direction and control of the war department, and shall receive the same compensation, for such time as they may be employed, as is allowed to other agents of the quartermaster's department.

SEC. 14. That the estimates of incomes and profits, other than those payable in kind, and the statements or bills for the amounts of the specific tax on occupations, employments, business and professions, and of taxes on gross sales shall be delivered by the assessor to the collector of the district, who shall give him a receipt for the same, and the said assessor shall file his receipt with the chief tax collector of the state, and the collector of the district holding said estimates, statements or bills, shall proceed to collect the same from the taxpayer. The money thus collected shall be paid to the chief taxcollector of the state, and the estimates, statements or bills aforesaid, shall be arranged by the assessor, and general lists shall be made from them in the same manner and for the same purposes designated by section thirteen of the assessment act.

SEC. 15. That every person who, as trustee, guardian, tutor, curator or committee, executor or administrator, or as agent, attorney in fact, or factor of any person or persons, whether residing in the Confederate States or not, and every receiver in chancery, clerk, register, or other officer of any court, shall be answerable for the doing of all such acts, matters and things as shall be required to be done in order to the assessment of the money, property, products and income under their control and the payment of taxes thereon, and shall be indemnified against all

Page 20

and every person for all payments on account of the taxes herein specified, and shall be responsible for all taxes due from the estates, income, money or property in their possession or under their control.

SEC. 16. The income and moneys of hospitals, asylums, churches, schools and colleges shall be exempt from taxation under the provisions of this act.

SEC. 17. That the secretary of the treasury be and he is hereby authorized to make all rules and regulations necessary to the operations of this act and not inconsistent herewith.

SEC. 18. This act shall be in force for two years after the expiration of the present year, and the taxes herein imposed for the present year shall levied and collected each year thereafter in the manner and form herein prescribed, and for the said time of two years, unless this act shall be sooner repealed.

Approved February 17, 1864.

A true copy.

J. M. MATTHEWS,

Law Clerk Dep. Jus.

An act to levy additional taxes for the common defence and support of the government.

The congress of the Confederate States of America do enact, That in addition to the taxes levied by the act to lay taxes for the common defence and to carry on the government of the Confederate States, approved twenty-fourth of April 1863, there shall be levied from the passage of this act, on the subjects of taxation hereafter mentioned, and collected from every person, copartnership, association or corporation liable thereto, taxes as follows, to wit,

I. Upon the value of property, real, personal and mixed, of every kind and description, not hereinafter exempted or taxed at a different rate, five per centum: provided, that from this tax on the value of property employed in agriculture shall be deducted the value of the tax in kind derived therefrom, as assessed under the law imposing it, and delivered to the government: provided, that no credit shall be allowed beyond five per centum.

Page 21

II. On the value of gold and silver wares and plate, jewels, jewelry and watches, ten per centum.

III. The value of property taxed under this section shall be assessed on the basis of the market value of the same, or similar property in the neighborhood where assessed in the year 1860, except in cases where land, slaves, cotton or tobacco have been purchased since the first day of January 1862, in which case the said land, slaves, cotton and tobacco so purchased, shall be assessed at the price actually paid for the same by the owner.

SEC. 2. On the value of all shares or interests held in any bank, banking company or association, canal, navigation, importing and exporting, insurance, manufacturing, telegraph, express, railroad and dry dock companies, and all other joint stock companies of every kind, whether incorporated or not, five per centum.

The value of property taxed under this section shall be assessed upon the basis of the market value of said property in the neighborhood where assessed, in such currency as may be in general use there in the purchase and sale of such property at the time of assessment.

SEC. 3. I. Upon the amount of all gold and silver coin, gold dust, gold or silver bullion, whether held by banks or other corporations or individuals, five per centum; and upon all moneys held abroad, or upon the amount of all bills of exchange, drawn therefor on foreign countries, a tax of five per centum; such tax upon money abroad to be assessed and collected according to the value thereof at the place where the tax is paid.

II. Upon the amount of all solvent credits, and of all bank bills, and all other paper issued as currency, exclusive of non-interest bearing confederate treasury notes, and not employed in a registered business, the income derived from which is taxed five per centum.

SEC. 4. Upon profits made in trade and business, as follows:

I. On all profits made by buying and selling spirituous liquors, flour, wheat, corn, rice, sugar, molasses or syrup, salt, bacon, pork, hogs, beef or beef cattle, sheep, oats, hay, fodder, raw hides, leather, horses, mules, boots, shoes, cotton yarns, wool, woollen, cotton or mixed cloths, hats, wagons, harness, coal, iron, steel or nails, at any time between the first of January 1863 and the first of January 1865, ten per centum, in addition to the tax on such profits as income under the act

Page 22

to lay taxes for the common defence and carry on the government of the Confederate States, approved April 24th, 1863.

II. On all profits made by buying and selling money, gold, silver, foreign exchange, stocks, notes, debts, credits, or obligations of any kind, and any merchandise, property or effects of any kind not enumerated in the preceding paragraph, between the times named therein, ten per centum, in addition to the tax on such profits as income, under the act aforesaid.

III. On the amount of profits exceeding twenty-five per centum, made during either of the years 1863 and 1864 by any bank or banking company, insurance, canal, navigation, importing and exporting, telegraph, express, railroad, manufacturing, dry dock, or other joint stock company of any description, whether incorporated or not, twenty-five per centum on such excess.

SEC 5. The following exemptions from taxation under this act shall be allowed, to wit:

I. Property of each head of a family to the value of five hundred dollars; and for each minor child of the family to the further value of one hundred dollars, and for each son actually engaged in the army or navy, or who has died or been killed in the military or naval service, and who was a member of the family when he entered the service, to the further value of five hundred dollars.

II. Property of the widow of any officer, soldier, sailor or marine, who may have died or been killed in the military or naval service, or where there is no widow, then of the family, being minor children, to the value of one thousand dollars.

III. Property of every officer, soldier, sailor or marine, actually engaged in military or naval service, or of such as have been in such service, to the value of one thousand dollars: provided that the above exemptions shall not apply to any person whose property, exclusive of household furniture, shall be assessed at a value exceeding one thousand dollars.

IV. That where property has been injured or destroyed by the enemy, or the owner thereof has been temporarily deprived of the use or occupancy thereof, or of the means of cultivating the same, by reason of the presence or proximity of the enemy, the assessment on such property may be reduced in proportion to the damage sustained by the

Page 23

owner, or the tax assessed thereon may be reduced in the same ratio by the district collector, on satisfactory evidence submitted to him by the owner or assessor.

SEC 6. That the taxes on property laid for the year 1864 shall be assessed as on the day of the passage of this act, and be due and collected on the first day of June next, or as soon after as practicable, allowing an extension of ninety days west of the Mississippi river. The additional taxes on incomes or profits for the year 1863, levied by this act, shall be assessed and collected forthwith; and the taxes on incomes or profits for the year 1864 shall be assessed and collected according to the provisions of the tax and assessment acts of 1863.

SEC. 7. So much of the tax act of the twenty-fourth day of April 1863 as levies a tax on incomes derived from property or effects on the amount or value of which a tax is levied by this act, and also the first section of said act, are suspended for the year 1864, and no estimated rent, hire or interest on property or credits herein taxed ad valorem, shall be assessed or taxed as incomes, under the tax act of 1863.

SEC. 8. That the tax imposed by this act on bonds of the Confederate States heretofore issued, shall in no case exceed the interest on the same, and such bonds, when held by or for minors or lunatics, shall be exempt from the tax in all cases where the interest on the same shall not exceed one thousand dollars.

Approved February 17, 1864.

A true copy.

JAMES M. MATTHEWS,

Law Clerk Dep. Jus.

Page 24

CURRENCY LAW.

An act to reduce the currency and to authorize the issue of new notes and bonds.

The congress of the Confederate States of America do enact, That the holders of all treasury notes above the denomination of five dollars, not bearing interest, shall be allowed until the first day of April 1864, east of the Mississippi river, and until the first day of July 1864, west of the Mississippi river, to fund the same, and until the periods and at the places stated, the holders of all such treasury notes shall be allowed to fund the same in registered bonds, payable twenty years after their date, bearing interest at the rate of four per centum per annum, payable on the first day of January and July of each year.

SEC. 2. The secretary of the treasury is hereby authorized to issue the bonds required for the funding provided for in the preceding section, and until the bonds can be prepared he may issue certificates to answer the purpose. Such bonds and certificates shall be receivable without interest in payment of all government dues payable in the year 1864, except export and import duties.

SEC. 3. That all treasury notes of the denomination of one hundred dollars, not bearing interest, which shall not be presented for funding under the provisions of the first section of this act, shall, from and after the first day of April 1864, east of the Mississippi river, and the first day of July 1864 west of the Mississippi river, cease to be receivable in the payment of public dues; and said notes, if not so presented at that time shall, in addition to the tax of thirty-three and one-third cents imposed in the fourth section of this act, be subject to a tax of ten per centum per month until so presented, which taxes shall attach to said notes wherever circulated, and shall be deducted from the face of said notes whenever presented for payment or for funding, and said notes shall not be exchangeable for the new issue of treasury notes provided for in this act.

Page 25

SEC. 4. That on all said treasury notes not funded or used in payment of taxes at the dates and places prescribed in the first section of this act, there shall be levied at said dates and places a tax of thirty-three and one-third cents for every dollar promised on the face of said notes. Said tax shall attach to said notes wherever circulated, and shall be collected by deducting the same at the treasury, its depositories, and by the tax collectors, and by all government officers receiving the same, whenever presented for payment, or for funding, or in payment of government dues, or for postage, or in exchange for new notes as hereinafter provided; and said treasury notes shall be fundable in bonds, as provided in the first section of this act, until the first day of January 1865, at the rate of sixty-six and two-third cents on the dollar.

And it shall be the duty of the secretary of the treasury at any time between the first April east, and the first July 1864 west of the Mississippi river, and the first January 1865, to substitute and exchange new treasury notes for the same, at the rate of sixty-six and two-third cents on the dollar: provided, that notes of the denomination of one hundred dollars shall not be entitled to the privilege of said exchange: provided further, that the right to fund any of said treasury notes after the first day of January 1865, is hereby taken away: and provided further, that upon all such treasury notes which may remain outstanding on the first January 1865, and which may not be exchanged for new treasury notes as herein provided, a tax of one hundred per centum is hereby imposed.

SEC. 5. That after the first day of April next, all authority heretofore given to the secretary of the treasury to issue treasury notes, shall be and is hereby revoked: provided, the secretary of the treasury may after that time issue new treasury notes, in such form as he may prescribe, payable two years after the ratification of a treaty of peace with the United States, said new issues to be receivable in payment of all public dues except export and import duties, and to be issued in exchange for old notes, at the rate of two dollars of the new for three dollars of the old issues, whether said old notes be surrendered for exchange by the holders thereof, or be received into the treasury under the provisions of this act; and the holders of the new notes or of the old notes, except those of the denomination of one hundred dollars, after they are reduced to sixty-six and two-third cents on the dollar, by the tax aforesaid, may convert the same into call certificates, bearing interest at the rate of four per centum per annum, and payable two years after the

Page 26

ratification of a treaty of peace with the United States, unless sooner converted into new notes.

SEC. 6. That to pay the expenses of the government not otherwise provided for, the secretary of the treasury is hereby authorized to issue six per centum bonds, to an amount not exceeding five hundred millions of dollars, the principal and interest whereof shall be free from taxation, and for the payment of the interest thereon the entire net receipts of any export duty hereafter laid on the value of all cotton, tobacco and naval stores which shall be exported from the Confederate States, and the net proceeds of the import duties now laid, or so much thereof as may be necessary to pay annually the interest, are hereby specially pledged: provided that the duties now laid upon imports and hereby pledged, shall hereafter be paid in specie, or in sterling exchange, or in the coupons of said bonds.

SEC. 7. That the secretary of the treasury is hereby authorized, from time to time, as the wants of the treasury may require it, to sell or hypothecate for treasury notes said bonds, or any part thereof, upon the best terms he can, so as to meet appropriations by congress, and at the same time reduce and restrict the amount of the circulation in treasury notes within reasonable and safe limits.

SEC. 8. The bonds authorized by the sixth section of this act may be either registered or coupon bonds, as the parties taking them may elect, and they may be exchanged for each other under such regulations as the secretary of the treasury may prescribe. They shall be for one hundred dollars, or some multiple of one hundred dollars, and shall, together with the coupons thereto attached, be in such form and of such authentication as the secretary of the treasury may prescribe. The interest shall be payable half yearly on the first January and July in each year--the principal shall be payable not less than thirty years from their date.

SEC. 9. All call certificates shall be fundable, and shall be taxed in all respects as is provided for the treasury notes into which they are convertible. If not converted before the time fixed for taxing the treasury notes, such certificates shall, from that time, bear interest upon only sixty-six and two-third cents for every dollar promised upon their face, and shall be redeemable only in new treasury notes at that rate; but after the passage of this act no call certificates shall be issued until after the first day of April 1864.

Page 27

SEC. 10. That if any bank of deposit shall give its depositors the bonds authorized by the first section of this act in exchange for their deposits, and specify the same on the bonds by some distinctive mark or token, to be agreed upon with the secretary of the treasury, then the said depositors shall be entitled to receive the amount of said bonds in treasury notes bearing no interest and outstanding at the passage of this act: provided, the said bonds are presented before the privilege of funding said notes at par shall cease, as herein prescribed.

SEC. 11. That all treasury notes heretofore issued of the denomination of five dollars shall continue to be receivable in payment of public dues, as provided by law, and fundable at par under the provisions of this act, until the first of July 1864 east, and until the first of October 1864 west of the Mississippi river, but after that time they shall be subject to a tax of thirty-three and one-third cents on every dollar promised on the face thereof, said tax to attach to said notes wherever circulated, and said notes to be fundable and exchangeable for new treasury notes, as herein provided, subject to the deduction of said tax.

SEC. 12. That any state holding treasury notes received before the time herein fixed for taxing said notes, shall be allowed until the first day of January 1865 to fund the same in six per centum bonds of the Confederate States, payable twenty years after date, and the interest payable semi-annually. But all treasury notes received by any state after the time fixed for taxing the same, as aforesaid, shall be held to have been received diminished by the amount of said tax. The discrimination between the notes subject to the tax and those not so subject, shall be left to the good faith of each state, and the certificate of the governor thereof shall in each case be conclusive.

SEC. 13. That treasury notes heretofore issued, bearing interest at the rate of seven dollars and thirty cents on the hundred dollars per annum, shall no longer be received in payment of public dues, but shall be deemed and considered bonds of the Confederate States, payable two years after a ratification of a treaty of peace with the United States, bearing the rate of interest specified on their face, payable on the first January in each and every year.

SEC. 14. That the secretary of the treasury be, and he is hereby authorized, in case the exigencies of the government should require it, to pay the demand of any public creditor whose debt may be contracted after the passage of this act, willing to receive the same, in a certificate

Page 28

of indebtedness to be issued by said secretary, in such form as he may deem proper, payable two years after a ratification of a treaty of peace with the United States, bearing interest at the rate of six per centum per annum, payable semi-annually, and transferable only by special endorsement under regulations to be prescribed by the secretary of the treasury, and said certificates shall be exempt from taxation in principal and interest.

SEC. 15. The secretary of the treasury is authorized to increase the number of depositories so as to meet the requirements of this act, and with that view, to employ such of the banks of the several states as he may deem expedient.

SEC. 16. The secretary of the treasury shall forthwith advertise this act in such newspapers published in the several states and by such other means as shall secure immediate publicity, and the secretary of war and the secretary of the navy shall each cause it to be published in general orders for the information of the army and navy.

SEC. 17. The forty-second section of the act for the assessment and collection of taxes, approved May 1st, 1863, is hereby repealed.

SEC. 18. The secretary of the treasury is hereby authorized and required, upon the application of the holder of any call certificate--which by the first section of the act to provide for the funding and further issue of treasury notes, approved March 22d, 1863, was required to be thereafter deemed to be a bond--to issue to such holder a bond therefor upon the terms provided by said act.

Approved February 17th, 1864.

A true copy.

JAMES M. MATTHEWS,

Law Clerk Dep. Jus.

Page 29

CONSCRIPTION LAW.

An act to organize forces to serve during the war.

The congress of the Confederate States of America do enact, That from and after the passage of this act, all white men, residents of the Confederate States, between the ages of seventeen and fifty, shall be in the military service of the Confederate States for the war.

SEC. 2. That all the persons aforesaid between the ages of eighteen and forty-five, now in service, shall be retained during the present war with the United States in the same regiments, battalions and companies to which they belong at the passage of this act, with the same organization and officers, unless regularly transferred or discharged in accordance with the laws and regulations for the government of the army: provided that companies from one state, organized against their consent, expressed at the time, with regiments or battalions from another state, shall have the privilege of being transferred to organizations of troops in the same arm of the service from the states in which said companies were raised, and the soldiers from one state in companies from another state shall be allowed, if they desire it, a transfer to organizations from their own states in the same arm of the service.

SEC. 3. That at the expiration of six months from the first day of April next, a bounty of one hundred dollars, in a six per centum government bond, which the secretary of the treasury is hereby authorized to issue, shall be paid to every non-commissioned officer, musician and private who shall then be in the service, or in the event of his death previous to the period of such payment, then to the person or persons who would be entitled by law to receive the arrearages of his pay; but no one shall be entitled to the bounty herein provided who shall at any time during the period of six months next after the first day of April, be absent from his command without leave.

Page 30

SEC. 4. That no person shall be relieved from the operation of this act by reason of having been heretofore discharged from the army, where no disability now exists, nor shall those who have furnished substitutes be any longer exempted by reason thereof: provided, that no person heretofore exempted on account of religious opinions, and who has paid the tax levied to relieve him from service, shall be required to render military service under this act.

SEC. 5. That all white male residents of the Confederate States, between the ages of seventeen and eighteen and forty-five and fifty years shall enrol themselves, at such times and places, and under such regulations as the president may prescribe, the time allowed not being less than thirty days for those east, and sixty days for those west of the Mississippi river, and any person who shall fail so to enrol himself, without a reasonable excuse therefor, to be judged of by the president, shall be placed in service in the field for the war, in the same manner as though he were between the ages of eighteen and forty-five: provided that the persons mentioned in this section shall constitute a reserve for state defence and detail duty, and shall not be required to perform service out of the state in which they reside.

SEC. 6. That all persons required by the fifth section of this act to enrol themselves may, within thirty days after the passage hereof, east of the Mississippi river, and within sixty days if west of said river, form themselves into voluntary organizations of companies, battalions or regiments, and elect their own officers--said organizations to conform to the existing law, and having so organized, to tender their services as volunteers during the war to the president; and if such organization shall furnish proper muster rolls, as now required, and deposit a copy thereof with the enrolling officer of their district, (which shall be equivalent to enrolment,) they may be accepted as minute men for service in such state, but in no event to be taken out of it. Those who do not so volunteer and organize, shall enrol themselves as before provided, and may by the president be required to assemble at places of rendezvous, and be formed into companies, battalions and regiments, under regulations to be prescribed by him, and shall have the right to elect their company and regimental officers; and all troops organized under this act for state defence shall be entitled, while in actual service, to the same pay and allowances as troops now in the field.

SEC. 7. That any person who shall fail to attend at the place of rendezvous, as required by the authority of the president, without a

Page 31

sufficient excuse, to be judged of by him, shall be liable to be placed in service in the field for the war, as if he were between the ages of eighteen and forty-five years.

SEC. 8. That hereafter the duties of provost and hospital guards and clerks, of clerks, guards, agents, employees or laborers in the commissary's and quartermaster's departments, in the ordnance department and clerks and employees of navy agents, as also in the execution of the enrolment acts, and all similar duties, shall be performed by persons who are within the ages of eighteen and forty-five years, and who, by the report of a board of army surgeons, shall be reported as unable to perform active service in the field, but capable of performing some of the above named duties, specifying which; and when those persons shall have been assigned to those duties as far as practicable, the president shall detail or assign to their performance such bodies of troops or individuals, required to be enrolled under the fifth section of this act as may be needed for the discharge of such duties: provided, that persons between the ages of seventeen and eighteen shall not be assigned to these duties: provided further, that nothing contained in this act shall be so construed as to prevent the president from detailing artisans, mechanics, or persons of scientific skill to perform indispensable duties in the departments or bureaux herein mentioned.

SEC. 9. That any quartermaster or assistant quartermaster, commissary or assistant commissary, (other than those serving with regiments and brigades in the field,) or officer in the ordnance bureau, or navy agent, or provost marshal, or officer in the conscript service, who shall hereafter employ or retain in his employment any person in any of their said departments or bureaux, or in any of the duties mentioned in the eighth section of this act, in violations of the provisions hereof, shall on conviction thereof, by a court martial or military court, be cashiered; and it shall be the duty of any department or district commander, upon proof by the oath of any credible person, that any such officer has violated this provision, immediately to relieve such officer from duty, and said commander shall take prompt measures to have him tried for such offence; and any commander as aforesaid failing to perform the duties enjoined by this section, shall, upon being duly convicted thereof, be dismissed from the service.

SEC. 10. That all laws granting exemptions from military service be and the same are hereby repealed, and hereafter none shall be exempted except the following:

Page 32

I. All who shall be held unfit for military service, under rules to be prescribed by the secretay of war.

II. The vice-president of the Confederate States, the members and officers of congress and of the several state legislatures, and such other confederate and state officers as the president or the governors of the respective states may certify to be necessary for the proper administration of the confederate or state governments, as the case may be.

III. Every minister of religion authorized to preach according to the rules of his church, and who, at the passage of this act, shall be regularly employed in the discharge of his ministerial duties; superintendents and physicians of asylums for the deaf, dumb and blind and of the insane; one editor for each newspaper being published at the time of the passage of this act, and such employees as said editor may certify on oath to be indispensable to the publication of such newspaper; the public printer of the confederate and state governments, and such journeymen printers as the said public printer shall certify on oath to be indispensable to perform the public printing; one skilled apothecary in each apothecary store, who was doing business as such apothecary on the tenth day of October 1862, and has continued said business without intermission since that period; all physicians over the age of thirty years who now are, and for the last seven years have been in the actual and regular practice of their profession; but the term physician shall not include dentists.

IV. All presidents and teachers of colleges, theological seminaries, academies and schools, who have been regularly engaged as such for two years next before the passage of this act: provided that the benefit of this exemption shall extend to those teachers only whose schools are composed of twenty students or more. All superintendents of public hospitals established by law before the passage of this act, and such physicians and nurses therein as such superintendent shall certify on oath to be indispensable to the proper and efficient management thereof.

V. There shall be exempt one person as overseer or agriculturalist on each farm or plantation upon which there are now and were, on the first day of January last, fifteen able-bodied field hands between the ages of sixteen and fifty, upon the following conditions: 1. This exemption shall only be granted in cases in which there is no white male adult on the farm or plantation not liable to military service, nor unless the person claiming the exemption was, on the first day of January 1864,

Page 33