Tariff of the Confederate States of America

Approved by Congress, May 21, 1861.

To Be of Force From and After August 31, 1861:

Electronic Edition.

Confederate States of America

Funding from the Institute of

Museum and Library

Services

supported the electronic publication of this

title.

Text scanned (OCR) by

Melissa Maxwell Edwards

Image scanned by

Melissa Maxwell Edwards

Text encoded by

Melissa Maxwell Edwards and Natalia Smith

First edition, 1999

ca. 60 K

Academic Affairs Library, UNC-CH

University of North Carolina at Chapel Hill,

1999.

Call number 41 Conf. 1861 (Rare Book Collection, University of North Carolina at Chapel Hill)

The electronic edition

is a part of the UNC-CH

digitization project, Documenting the American

South.

Any hyphens occurring

in line breaks have been

removed, and the trailing part of a word has been joined to

the preceding line.

All quotation marks,

em dashes and ampersand have been transcribed as

entity references.

All double right and

left quotation marks are encoded as "

and "

respectively.

All single right and

left quotation marks are encoded as '

and ' respectively.

All em dashes are

encoded as --

Indentation in lines

has not been preserved.

Spell-check and

verification made against printed text using

Author/Editor (SoftQuad) and Microsoft Word spell check programs.

Library of Congress Subject Headings, 21st edition, 1998

LC Subject Headings:

- Tariff -- Law and legislation -- Confederate States of America.

- Foreign trade regulation -- Confederate States of America.

- Trade regulation -- Confederate States of America.

- Legislation -- Confederate States of America.

- Confederate States of America -- Commerce.

- Confederate States of America -- Foreign relations.

- 1999-06-17,

Celine Noel and Wanda Gunther

revised TEIHeader and created catalog record for the electronic edition.

-

1999-05-18,

Natalia Smith, project manager,

finished TEI-conformant encoding and final proofing.

-

1999-05-17,

Melissa Maxwell Edwards

finished TEI/SGML encoding

- 1999-05-06,

Melissa Maxwell Edwards

finished scanning (OCR) and proofing.

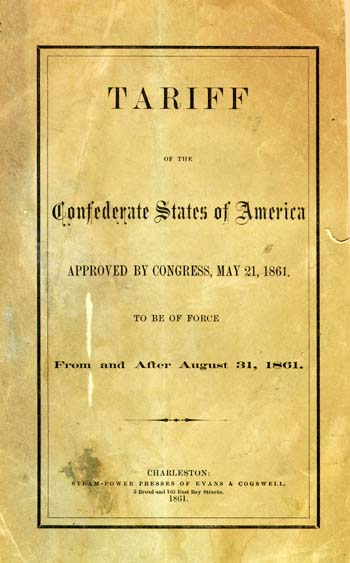

TARIFF

OF THE

Confederate States of America

APPROVED BY CONGRESS, MAY 21, 1861.

TO BE OF FORCE

From and After August 31, 1861.

CHARLESTON:

STEAM-POWER PRESSES OF EVANS & COGSWELL,

3 Broad and 103 East Bay Streets.

1861.

Page 2

Treasury Circular, No. 10.

CONFEDERATE STATES OF AMERICA,

TREASURY DEPARTMENT,

Richmond, June 7, 1861.

In performance of the duty imposed by law on this Department of superintending the collection of the public Revenue, the attention of Collectors and other officers of the Customs is called to the provisions of the Act of Congress of the Confederate States of America, levying duties on imports, approved May 21, 1861, which will be in force on and after the thirty-first day of August next. All the existing regulations to ascertain the identity of goods, wares and merchandize, the growth, produce or manufacture of the Confederate States, exported to a foreign country and brought back to the Confederate States in the same condition as when exported, upon which no drawback has been allowed, will be in force, and Collectors or other officers of the Customs will be governed accordingly. The Tariff Act, approved May 21, 1861, having superseded all previous Tariff Acts, the provisions of the same are hereto subjoined, with the Tariff of duties arranged in schedules. The law is so free from ambiguity, and so plain in its provisions, that the Department conceives any exposition of its views, interpreting the same, at this time, as unnecessary. If difference of opinion should arise in its construction, it will be developed in the practical workings of the law, and Collectors and other officers of the Customs will call the attention of the Department to any difficulty that may be presented, thereby affording an opportunity for an early construction of the law.

C. G. MEMMINGER,

Secretary of the Treasury.Page 3

ACT

TO PROVIDE REVENUE FROM COMMODITIES

IMPORTED FROM FOREIGN COUNTRIES.

SECTION 1.

The Congress of the Confederate States of America do enact, That from and after the 31st day of August next, a duty shall be imposed on all goods, products, wares and merchandize imported from abroad into the Confederate States of America, as follows:

On all articles enumerated in Schedule A, an ad valorem duty of twenty-five per centum. On all articles enumerated in Schedule B, an ad valorem duty of twenty per centum. On all articles enumerated in Schedule C, an ad valorem duty of fifteen per centum. On all articles enumerated in Schedule D, an ad valorem duty of ten per centum. On all articles enumerated in Schedule E, an ad valorem duty of five per centum. And that all articles enumerated in Schedule F, a Specific Duty as therein named. And that all articles enumerated in Schedule G, shall be exempt from duty: to wit:

SCHEDULE A.

TWENTY-FIVE per centum ad valorem.

Alabaster and spar ornaments; anchovies, sardines, and all other fish preserved in oil.

Brandy and other spirits distilled from grain or other materials, not otherwise provided for; billiard and bagatelle tables, and all other tables or boards on which games are played.

Composition tops for tables, or other articles of furniture; confectionary, comfits, sweetmeats, or fruits preserved in sugar, molasses, brandy or other liquors; cordials, absynthe, arrack, curacoa, kirschenwesser, liquors, maraschino, ratafia, and all other spirituous beverages of a similar character.

Page 4

Glass, cut.

Manufactures of cedarwood, granadilla, ebony, mahogany, rosewood and satinwood.

Scagliola tops for tables or other articles of furniture; segars, snuff, paper-segars, and all other manufactures of tobacco.

Wines--Burgundy, champagne, clarets, madeira, port, sherry, and all other wines or imitations of wines.

SCHEDULE B.

TWENTY per centum ad valorem.

Almonds, raisins, currants, dates, figs, and all other dried or preserved fruits, not otherwise provided for; argentine, alabata, or German silver, manufactured or unmanufactured; articles embroidered with gold, silver, or other metal, not otherwise provided for.

Balsams, cosmetics, essences, extracts, pastes, perfumes, and tinctures, used for the toilet or for medicinal purposes; bay rum, beads of amber, composition or wax, and all other beads; benzoates; bracelets, braids, chains, curls, or ringlets, composed of hair, or of which hair is a component part, not otherwise provided for; brooms and brushes of all kinds.

Camphor, refined; canes and sticks, for walking, finished or unfinished; capers, pickles and sauces of all kinds, not otherwise provided for; card cases, pocket books, shell boxes, souvenirs, and all similar articles, of whatever material composed, not otherwise provided for; compositions of glass, set or unset; coral, cut or manufactured.

Feathers and flowers, artificial or ornamental, and parts thereof, of whatever material composed; fans and fire screens of every description, of whatever material composed.

Grapes, plums, and prunes, and other such fruit, when put up in bottles, cases or cans, not otherwise provided for.

Hair, human, cleansed or prepared for use.

Manufactures of gold, platina, or silver, not otherwise provided for; manufactures of papier maché; molasses.

Page 5

Paintings on glass; pepper, pimento, cloves, nutmegs, cinnamon, and all other spices; perfumes and perfumery, of all sorts, not otherwise provided for; plated and gilt ware of all kinds, not otherwise provided for; playing cards; prepared vegetables, fruits, meats, poultry and game, sealed or enclosed in cans or otherwise.

Silver-plated metals, in sheets or other form; soap, castile, perfumed, windsor, and other toilet soaps; sugar of all kinds; syrup of sugar.

Epaulettes, galloons, laces, knots, stars, tassels, tresses, and wings of gold or silver, or imitations thereof.

SCHEDULE C.

FIFTEEN per centum ad valorem.

Alum; arrow-root; articles of clothing or apparel, including hats, caps, gloves, shoes and boots of all kinds, worn by men, women or children, of whatever material composed, not otherwise provided for.

Baizes, blankets, bockings, flannels and floor-cloths, of whatever material composed, not otherwise provided for; baskets, and all other articles composed of grass, osier, palm leaf, straw, whalebone or willow, not otherwise provided for; beer, ale, and porter, in casks or bottles; bees-wax; berries and vegetables of all sorts used for food, not otherwise provided for; blue or roman vitriol, or sulphate of copper; Bologna sausages; braces, suspenders, webbing, or other fabrics, composed wholly or in part of India rubber, not otherwise provided for; breccia; burgundy pitch; buttons and button moulds of all kinds.

Cables and cordage, of whatever material made; cadmium; calamine; calomel and all other mercurial preparations; carbonate of soda; castor beans; castor oil; candles and tapers of spermaceti, stearine, parafine, tallow or wax, and all other candles; caps, hats, muffs and tippets, and all other manufactures of fur, or of which fur shall be a component part; caps, gloves, leggins, mits, socks, stockings, wove shirts and drawers, and all similar articles worn by men, women and children, and not otherwise provided

Page 6

for; carpets, carpeting, hearth-rugs, bed-sides, and other portions of carpeting, being either Aubusson, Brussels, ingrain, Saxony, Turkey, Venetian, Wilton, or any other similar fabric, not otherwise provided for; carriages and parts of carriages; castorum; chains, of all sorts; cider and other beverages not containing alcohol, and not otherwise provided for; chocolate; chromate of lead; chromate, bi-chromate, hydriodate, and prussiate of potash; clocks and parts of clocks; coach and harness furniture of all kinds; cobalt; combs of all kinds; copper bottoms; copper rods, bolts, nails, and spikes; copper in sheets or plates, called braziers' copper, and other sheets of copper, not otherwise provided for; copperas, or green vitriol, or sulphate of iron; corks; cotton cords, gimps, and galloons; cotton laces, cotton insertings, cotton trimming laces, cotton laces and braids; court plaster; coral unmanufactured; crayons of all kinds; cubebs; cutlery of all kinds.

Delaines; dolls and toys of all kinds; dried pulp; drugs, medicinal.

Earthen, china, and stone ware, and all other wares composed of earthy and mineral substances not otherwise provided for; encaustic tiles; ether; felspar; fig blue; fire-crackers, sky-rockets, Roman candles, and all similar articles used in pyrotechnics; fish, whether fresh, smoked, salted, dried or pickled, not otherwise provided for; fruits, preserved in their own juice, or pie fruits; fish glue, or isinglass; fish skins; flats, braids, plaits, sparterre and willow squares, used for making hats or bonnets; floss silks, feather beds, feathers for beds, and downs of all kinds; frames and sticks for umbrellas, parasols, and sunshades, finished or unfinished; Frankford black; fulminates, or fulminating powders; furniture, cabinet and household, not otherwise provided for; furs, dressed on the skin.

Ginger, dried, green, ripe, ground, preserved, or pickled; glass, colored, stained, or painted; glass, window; glass crystals for watches; glasses or pebbles for spectacles; glass tumblers, plain, moulded and pressed; bottles, flasks, and all other vessels of glass not cut, and all glass not otherwise provided for; glue; grass cloth; green turtle; gum

Page 7

benzoin, or benjamin; guns, except muskets and rifles, fire arms and all parts thereof not intended for military purposes; gunny cloth and India baggings and India mattings of all sorts, not otherwise provided for.

Hair, curled, moss, seaweed, and all other vegetable substances, used for beds or mattresses; hair pencils; hat bodies of cotton or wool; hats and bonnets, for men, women and children, composed of straw, satin straw, chip, grass, palm leaf, willow, or any other vegetable substance, or of hair, whalebone, or other materials not otherwise provided for; hatter's plush, of whatever material composed; honey.

Ink and ink powder; ipecacuanha; iridium; iris, or orris root; iron castings; iron liquor; iron in bars, bolts, rods, slabs, and railroad rails, spikes, fishing plates and chairs used in constructing railroads; ivory black.

Jalap; japanned ware of all kinds, not otherwise provided for; jet, and manufactures of jet, or imitations thereof; jewelry or imitations thereof; juniper berries.

Laces of cotton, of thread or other materials, not otherwise provided for; lampblack; lastings, cut in strips, or patterns of the size or shape for shoes, boots, bootees, slippers, gaiters or buttons, of whatever material composed; lead pencils; leaden pipes; leather, japanned; leeches; linens, of all kinds; liquorice, paste, juice or root; litharge.

Maccaroni, vermicelli, gelatine, jellies, and all other similar preparations, not otherwise provided for; machinery of every description, not otherwise provided for; malt; magnesia; manganese; manna; manufactures of the bark of the cork tree; manufactures of silk; manufactures of wool of all kinds, or worsted, not otherwise provided for; manufactures of hair of all kinds, not otherwise provided for; manufactures of cotton of all kinds, not otherwise provided for; manufactures of flax of all kinds, not otherwise provided for; manufactures of hemp of all kinds, not otherwise provided for; manufactures of bone, shell, horn, pearl, ivory, or vegetable ivory, not otherwise provided for; manufactures, articles, vessels and wares, not otherwise provided for, of brass, copper, iron, steel, lead, pewter, tin, or of which either of these metals shall be a component part;

Page 8

manufactures, articles, vessels, and wares, of glass, or of which glass shall be a component material, not otherwise provided for; manufactures and articles of leather, or of which leather shall be a component part, not otherwise provided for; manufactures and articles of marble, marble paving tiles, and all other marble more advanced in manufacture than in slabs or blocks in the rough, not otherwise provided for; manufactures of paper, or of which paper is a component material, not otherwise provided for; manufactures of wood, or of which wood is a component part, not otherwise provided for; matting, china or other floor matting, and mats made of flags, jute, or grass; medicinal preparations, drugs, roots, and leaves in a crude state, not otherwise provided for; morphine; metallic pens; mineral waters; musical instruments of all kinds, and strings for musical instruments, of whipgut, catgut, and all other strings of the same material; mustard, in bulk or in bottles; mustard seed.

Needles of all kinds, for sewing, darning and knitting; nitrate of lead.

Ochres and ochrey earths; oil-cloths of every description, of whatever material composed; oils of every description, animal, vegetable and mineral, not otherwise provided for; olives; opium; orange and lemon peel; osier or willow, prepared for basket-makers' use.

Paints, dry or ground in oil, not otherwise provided for; paper, antiquarian, demy, drawing, elephant, foolscap, imperial, letter, and for printing newspapers, hand-bills, and other printing, and all other paper, not otherwise provided for; paper boxes, and all other fancy boxes; paper envelopes; paper hangings; paper for walls, and paper for screens or fire-boards; parchment; parasols and sun-shades and umbrellas; patent mordant; paving and roofing tiles and bricks, and roofing slates, and fire-bricks; periodicals and other works, in course of printing and republication in the Confederate States; pitch; plaster of Paris, calcined; plumbago; potassium; putty.

Quicksilver; quills; quassia, manufactured or unmanufactured.

Page 9

Red chalk pencils; rhubarb; roman cement.

Saddlery of all kinds, not otherwise provided for; saffron and saffron cake; sago; salts, epsom, glauber, rochelle, and all other salts and preparations of salts, not otherwise provided for; sarsaparilla; screws of all kinds; sealing wax; seines; seppia; sewing silk, in the gum and purified; shaddocks; skins of all kinds, tanned, dressed, or japanned; slate pencils; smaltz; soap of every description not otherwise provided for; spirits of turpentine; spunk; squills; starch ; stereotype plates; still bottoms; sulphate of barytes, crude or refined; sulphate of quinine, and quinine in all its various preparations.

Tapioca; tar; textile fabrics of every description, not otherwise provided for; twine and pack thread, of whatever material composed; thread lacings and insertings; types, old or new, and type metals.

Umbrellas; vandyke brown; vanilla beans; varnish of all kinds, vellum; venetian red; velvet in the piece, composed wholly of cotton, or of cotton and silk, but of which cotton is the component material of chief value; verdigris; vermilion; vinegar.

Wafers; water colors; whalebone; white and red lead; white vitriol, or sulphate of zinc; whiting, or Paris white; window glass, broad, crown or cylinder; woollen and worsted yarns and woollen listings; shot of lead, not otherwise provided for; wheelbarrows and hand-barrows; wagons and vehicles of every description, or parts thereof.

SCHEDULE D.

TEN per centum ad valorem.

Acids of every description not otherwise provided for; alcornoque; aloes; ambergris; amber; ammonia, and sal ammonia; anatto, roucon or orleans; angora, thibet, and other goats' hair, or mohair, unmanufactured, not otherwise provided for; anniseed; antimony, crude or regulus of; argol, or crude tartar; arsenic; ashes, pot, pearl and soda; asphaltum; assafoetida.

Bananas, cocoa nuts, pine apples, plantains, oranges and

Page 10

all other West India fruits in their natural state; barilla; bark of all kinds, not otherwise provided for; bark, Peruvian; bark, guilla; bismuth; bitter apples; bleaching powder of chloride of lime: bones, burnt; boards, planks, staves, shingles, laths, scantling, and all other sawed lumber; also spars and hewn timber, of all sorts, not otherwise provided for; bone black, or animal carbon, and bone dust; bolting cloths; books, printed, magazines, pamphlets, periodicals, and illustrated newspapers, bound or unbound, not otherwise provided for; books, blank, bound or unbound; borate of lime; borax, crude or tincal; borax, refined; bouchu leaves; box-wood, unmanufactured; Brazil paste, Brazil wood, braziletto, and all dye-woods in sticks; bristles; bronze and Dutch metal in leaf; bronze liquor and bronze powder; building stones; butter; burr stones, wrought or unwrought.

Cabinets of coins, medals, gems, and all collections of antiquities; camphor; crude; cantharides; cassia and cassia buds; chalk; cheese; chickory root, chronometers, box or ship, and parts thereof; clay, burnt or unburnt bricks, paving and roofing tiles, gas retorts, and roofing slates; coal, coke, and culm of coal; cochineal; cocoa nuts, cocoa, and cocoa shells; coculus indicus; coir yarn; codilla, or tow of hemp or flax; cowhage down; cream of tartar; cudbear.

Diamonds, cameos, mosaics, gems, pearls, rubies and other precious stones, and imitations thereof, when set in gold or silver, or other metal; diamonds, glaziers', set or not set; dragon's blood.

Engravings, bound or unbound; extract of indigo, extracts and decoctions of log-wood and other dye-woods, not otherwise provided for; extract of madder; ergot.

Flax, unmanufactured; flaxseed and linseed; flints and flint ground; flocks, waste or shoddy; French chalk; furs, hatters', dressed or undressed, not on the skin; furs, undressed, when on the skin.

Glass, when old and fit only to be remanufactured; gamboge; gold and silver leaf; gold beaters' skin; grindstones; gums--Arabic, Barbary, copal, East Indies, Senegal,

Page 11

substitute, tragacanth, and all other gums and resins, in a crude state, not otherwise provided for.

Hair, of all kinds, uncleansed and unmanufactured; hemp, unmanufactured; hemp seed and rape seed; hops, horns, horn-tips, bone, bone-tips, and teeth, unmanufactured.

Ivory, unmanufactured; ivory nuts, or vegetable ivory.

Jute, sisal grass, coir, and other vegetable substances, unmanufactured, not otherwise provided for.

Kelp; kermes.

Lac spirits, lac sulphur, and lac dye; leather, tanned, bend, sole, and upper of all kinds, not otherwise provided for; lemons and limes, and lemon and lime juice, and juices of all other fruits without sugar; lime.

Madder, ground or prepared; madder root; marble, in the rough, slab or block, unmanufactured; metals, unmanufactured, not otherwise provided for; mineral kermes; mineral and bituminous substances in a crude state, not otherwise provided for; moss, iceland; music, printed with lines, bound or unbound.

Natron; nickel; nuts, not otherwise provided for; nut galls; nux vomica.

Oakum; oranges, lemons, and limes; orpiment.

Palm leaf, unmanufactured; pearl, mother of; pine apples; plantains; platina, unmanufactured; polishing stones; potatoes; Prussian blue; pumice and pumice stone.

Ratans and reeds, unmanufactured; red chalk;rotten stone.

Safflower; sal soda, and all carbonates and sulphates of soda, by whatever names designated, not otherwise provided for; seedlac; shellac; silk, raw, not more advanced in manufacture than singles, tram and thrown, or organzine; sponges; steel in bars, sheets and plates, not further advanced in manufacture than by rolling, and cast steel in bars; sumac; sulphur, flour of.

Tallow, marrow, and all other grease or soap stocks and soap stuffs, not otherwise provided for; tea, terne tin, in plates or sheets; teazle, terra japonica, catechu, tin in plates or sheets and tin foil; tortoise and other shells, unmanufactured; trees, shrubs, bulbs, plants and roots, not otherwise provided for; turmeric.

Page 12

Watches and parts of watches; woad or pastel; woods; viz., cedar, box, ebony, lignumvitæ, granadilla, mahogany, rose-wood, satin-wood, and all other woods, unmanufactured.

Iron ore, and iron in blooms, loops and pigs.

Maps and charts.

Paintings and statuary not otherwise provided for.

Wool, unmanufactured, of every description, and hair of the Alpaca goat and other like animals.

Specimens of natural history, mineralogy or botany, not otherwise provided for.

Yams.

Leaf and unmanufactured tobacco.

SCHEDULE E.

FIVE per centum ad valorem.

Articles used in dyeing and tanning, not otherwise provided for.

Brass, in bars or pigs, old and fit only to be remanufactured; bells, old; bell metal.

Copper in pigs or bars; copper ore; copper, when old and fit only to be remanufactured; cutch.

Diamonds, cameos, mosaics, pearls, gems, rubies, and other precious stones, and imitations thereof, when not set.

Emery in lump or pulverized.

Felt, adhesive for sheathing vessels; fuller's earth.

Gums of all sorts, not otherwise provided for; gutta percha, unmanufactured.

Indigo; india rubber, in bottles, slabs or sheets, unmanufactured; india rubber, milk of.

Junk, old.

Plaster of Paris or sulphate of lime, ground or unground; raw hides and skins of all kinds, undressed.

Sheathing copper, but no copper to be considered as such except in sheets forty-eight inches long and fourteen inches wide, and weighing from eleven to thirty-four ounces; sheathing or yellow metal not wholly or part of iron; sheathing or yellow metal nails, expressly for sheathing vessels; sheathing paper, stave bolts and shingle bolts.

Page 13

Tin ore and tin in pigs or bars; type, old and fit only to be remanufactured.

Wold.

Zinc, spelter, or tentenegue, unmanufactured.

SCHEDULE F.

Specific Duties.

Ice--one dollar and fifty cents per ton.

Salt, ground, blown, or rock--two cents per bushel, of fifty-six pounds per bushel.

SCHEDULE G.

Exempt from Duty.

Books, maps, charts, mathematical and nautical instruments, philosophical apparatus, and all other articles whatever, imported for the use of the Confederate States; books, pamphlets, periodicals and tracts, published by religious associations.

All philosophical apparatus, instruments, books, maps and charts, statues, statuary, busts and casts, of marble, bronze, alabaster or plaster of Paris, paintings and drawings, etchings, specimens of sculpture, cabinet of coins, medals, gems, and all collections of antiquities. Provided the same be specially imported in good faith for the use of any society, incorporated or established for philosophical and literary purposes, or for the encouragement of the fine arts, or for the use or by the order of any church, college, academy, school, or seminary of learning in the Confederate States.

Bullion, gold and silver.

Coins, gold, silver and copper; coffee; cotton; copper, when imported for the mint of the Confederate States.

Garden seeds, and all other seeds for agricultural and horticultural purposes; goods, wares and merchandize, the growth, produce or manufacture of the Confederate States, exported to a foreign country, and brought back to the Confederate States in the same condition as when exported, upon which no drawback has been allowed. Provided that all regulations to ascertain the identity thereof, prescribed

Page 14

by existing laws, or which may be prescribed by the Secretary of the Treasury, shall be complied with; guano, manures and fertilizers of all sorts.

Household effects, old and in use, of persons or families from foreign countries, if used abroad by them, and not intended for any other purpose or purposes, or for sale.

Models or inventions, or other improvements in the arts. Provided that no article or articles shall be deemed a model which can be fitted for use.

Paving stones; personal and household effects, not merchandize, of citizens of the Confederate States dying abroad.

Specimens of natural history, mineralogy or botany. Provided the same be imported in good faith for the use of any society incorporated or established for philosophical, agricultural or horticultural purposes, or for the use or by the order of any college, academy, school, or seminary of learning in the Confederate States.

Wearing apparel, and other personal effects not merchandize; professional books, implements, instruments and tools of trades, occupation or employment, of persons arriving in the Confederate States. Provided that this exemption shall not be construed to include machinery, or other articles imported for use in any manufacturing establishment, or for sale.

Bacon, pork, hams, lard, beef, wheat, flour and bran of wheat, flour and bran of all other grains, Indian corn and meal, barley, rye, oats and oatmeal, and living animals of all kinds, not otherwise provided for; also, all agricultural productions, including those of the orchard and garden, in their natural state, not otherwise provided for.

Gunpowder, and all the materials of which it is made.

Lead, in pigs or bars, in shot or balls, for cannon, muskets, rifles, or pistols.

Rags, of whatever material composed.

Arms, of every description, for military purposes and parts thereof, munitions of war, military accoutrements and percussion caps.

Ships, steamers, barges, dredging vessels, machinery,

Page 15

screw pile jetties, and articles to be used in the construction of harbors, and for dredging and improving the same.

SEC. 2.

And be it further enacted, That there shall be levied, collected and paid, on each and every non-enumerated article which bears a similitude, either in material, quality, texture, or the uses to which it may be applied, to any enumerated article chargeable with duty, the same rate of duty which is levied and charged on the enumerated article by the foregoing schedules, which it most resembles in any of the particulars before mentioned; and if any non-enumerated article equally resembles two or more enumerated articles on which different rates of duty are chargeable, there shall be levied, collected and paid, on such non-enumerated article, the same rate of duty as is chargeable on the article which it resembles, paying the highest duty. Provided, That on all articles manufactured from two or more materials, the duty shall be assessed at the highest rates at which any of its component parts may be chargeable. Provided further, That on all articles which are not enumerated in the foregoing schedules, and cannot be classified under this section, a duty of ten per cent. ad valorem shall be charged.

SEC. 3.

And be it further enacted, That all goods, wares and merchandize, which may be in the public stores as unclaimed, or in warehouse under warehousing bonds, on the 31st day of August next, shall be subject, on entry thereof for consumption, to such duty as if the same had been imported, respectively after that day.

SEC. 4.

And be it further enacted, That on the entry of any goods, wares or merchandize, imported on or after the 31st day of August aforesaid, the decision of the collector of customs at the port of importation and entry, as to their liability to duty or exemption therefrom, shall be final and conclusive against the owner, importer, consignee, or agent of any such goods, wares and merchandize, unless the owner, importer, consignee or agent shall, within ten days after such entry, give notice to the collector, in writing, of his dissatisfaction with such decision, setting forth therein distinctly and specifically his ground of objection thereto,

Page 16

and shall, within thirty days after the date of such decision, appeal therefrom to the Secretary of the Treasury, whose decision on such appeal shall be final and conclusive; and the said goods, wares and merchandize shall be liable to duty or exemption therefrom accordingly, any Act of Congress to the contrary notwithstanding, unless suit shall be brought within thirty days after such decision, for any duties that may have been paid, or may thereafter be paid on said goods, or within thirty days after the duties shall have been paid in cases where such goods shall be in bond.

SEC. 5.

And be it further enacted, That it shall be lawful for the owner, consignee, or agent of imports which have been actually purchased or procured otherwise than by purchase, on entry of the same, to make such addition in the entry to the cost or value given in the invoice as, in his opinion, may raise the same to the true market value of such imports in the principal markets of the country whence the importations shall have been made, and to add thereto all costs and charges which, under existing laws, would form part of the true value at the port where the same may be entered, upon which the duty should be assessed. And it shall be the duty of the collector within whose district the same may be imported or entered, to cause the dutiable value of such imports to be appraised, estimated and ascertained, in accordance with the provisions of existing laws; and if the appraised value thereof shall exceed by ten per centum, or more, the value so declared on entry, then in addition to the duties imposed by law on the same, there shall be levied, collected and paid a duty of twenty per centum ad valorem, on such appraised value. Provided, nevertheless, That under no circumstances shall the duty be assessed upon an amount less than the invoice or entered value, any law of Congress to the contrary notwithstanding.

SEC. 6.

And be it further enacted, That so much of all Acts or parts of Acts as may be inconsistent with the provisions of this Act shall be, and the same are hereby repealed.

Approved May 21, 1861.