The Statutes at Large of the Confederate States of America,

Passed at the Fourth Session of the First Congress; 1863-4.

Carefully Collated with the Originals at Richmond.

Public Laws of the Confederate States of America, Passed at the

Fourth Session of the First Congress; 1863-4. Private Laws of the Confederate States of America,

Passed at the Fourth Session of the First Congress; 1863-4:

Electronic Edition.

Confederate States of America.

Matthews, James M. (James Muscoe), b. 1822. Ed.

Funding from the Institute of Museum and Library

Services

supported the electronic publication of this title.

Text transcribed by Apex Data Services, Inc.

Images scanned by

Joshua G. McKim

Text encoded by

Apex Data Services, Inc. and Joshua G. McKim

First edition, 2001

ca. 700K

Academic Affairs Library, UNC-CH

University of North Carolina at Chapel Hill,

2001.

Source Description:

(cover) By Authority. The Statutes at Large of the Confederate States of America, Passed at the Fourth Session of the First Congress; 1863-4. Carefully Collated with the Originals at Richmond.

(first title page) Public Laws of the Confederate States of America, Passed at the Fourth Session of the First Congress; 1863-4. Carefully Collated with the Originals at Richmond.

(second title page) Private Laws of the Confederate States of America, Passed at the Fourth Session of the First Congress; 1863-4. Carefully Collated with the Originals at Richmond.

Edited by James M. Matthews

viii, 171-252, xxiii, [iii], 13-15 p.

Richmond:

R. M. Smith. Printer to Congress.

1864.

Call number 23conf (Rare Book Collection, University of North Carolina at Chapel Hill)

The electronic edition is a part of the UNC-CH digitization project, Documenting the American South.

The text has been entered using double-keying and verified against the original.

The text has been encoded using the

recommendations for Level 4 of the TEI in Libraries Guidelines.

Original grammar, punctuation, and spelling have been preserved. Encountered

typographical errors have been preserved and appear in red type.

At head of cover title appears: "By Authority."

All footnotes are inserted at the point of reference within paragraphs.

All marginal notes are placed before the relevant paragraph or section of the text.

Any hyphens occurring in line breaks have been

removed, and the trailing part of a word has been joined to

the preceding line.

All quotation marks, em dashes and ampersand have been transcribed as

entity references.

All double right and left quotation marks are encoded as " and "

respectively.

All single right and left quotation marks are encoded as ' and ' respectively.

All em dashes are encoded as --

Indentation in lines has not been preserved.

Running titles have not been preserved.

Spell-check and verification made against printed text using Author/Editor (SoftQuad) and Microsoft Word spell check programs.

Library of Congress Subject Headings, 21st edition, 1998

Languages Used:

- English

LC Subject Headings:

- Civil law -- Confederate States of America.

- Confederate States of America.

- Indians of North America -- Confederate States of America.

- Law -- Confederate States of America.

- Legislation -- Confederate States of America.

- Public law -- Confederate States of America.

Revision History:

- 2001-03-29,

Celine Noel and Wanda Gunther

revised TEIHeader and created catalog record for the electronic edition.

-

2001-03-01,

Joshua G. McKim

finished TEI-conformant encoding and final proofing.

-

2001-01-28,

Joshua G. McKim

finished TEI/SGML encoding

- 2000-10-15,

Apex Data Services, Inc.

finished text transcription.

BY AUTHORITY.

THE

STATUTES AT LARGE

OF THE

Confederate States of America,

PASSED AT THE FOURTH SESSION OF THE

FIRST CONGRESS;

1863-4.

Carefully collated with the Originals at Richmond

EDITED BY

JAMES M. MATTHEWS,

ATTORNEY AT LAW,

AND LAW CLERK IN THE DEPARTMENT OF JUSTICE.

TO BE CONTINUED ANNUALLY.

RICHMOND:

R. M. SMITH, PRINTER TO CONGRESS.

1864.

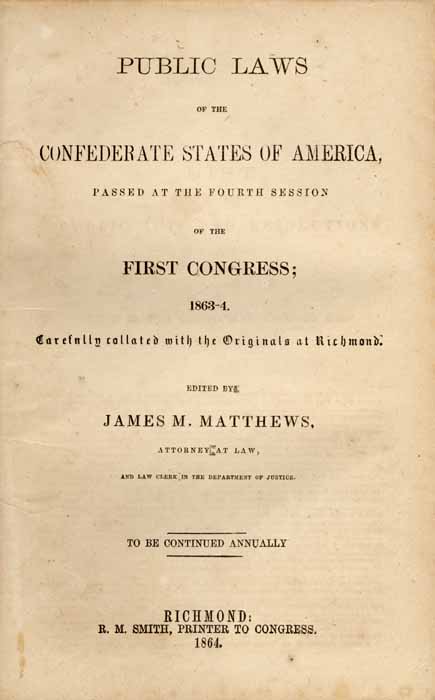

PUBLIC LAWS

OF THE

CONFEDERATE STATES OF AMERICA,

PASSED AT THE FOURTH SESSION

OF THE

FIRST CONGRESS;

1863-4.

Carefully collated with the Originals at Richmond.

EDITED BY

JAMES M. MATTHEWS,

ATTORNEY AT LAW,

AND LAW CLERK IN THE DEPARTMENT OF JUSTICE.

TO BE CONTINUED ANNUALLY

RICHMOND:

R. M. SMITH, PRINTER TO CONGRESS.

1864.

Page iii

LIST

OF THE

PUBLIC ACTS AND RESOLUTIONS

OF CONGRESS.

- Commutation of tax in kind on sweet potatoes. An Act to amend so much of section eleven of the Tax Law as requires one-tenth of the sweet potatoes produced this year to be paid to the Government. December 28, 1863, ch. 1 171

- Commutation of tax in kind on bacon. An Act authorizing the tax in kind on bacon to be commuted by collection of salt pork as an equivalent. December 28, 1863, ch. 2 171

- Enlistment of substitutes in the military service, prevented. An Act to prevent the enlistment or enrollment of substitutes in the military service of the Confederate States. December 28, 1863, ch. 3 172

- No person exempted from military service by reason of having furnished a substitute. An Act to put an end to the exemption from military service of those who have heretofore furnished substitutes. January 5, 1864, ch. 4 172

- Vacancies in the representation of any Indian Nation in Congress, filled by special election. An Act providing for filling vacancies of delegates to Congress in certain Indian Nations. January 5, 1864, ch. 5 172

- Pay of officers, &c., on detailed or detached service, continued. An Act to continue in force an act entitled "An Act to provide for the compensation of certain persons therein named," approved May the first, eighteen hundred and sixty-three. January 6, 1864, ch. 6 172

- Appointment of Third Auditor of the Treasury. An Act to authorize the appointment of a Third Auditor of the Treasury. January 8, 1864, ch. 7 173

- Cancellation of certain Confederate States Bonds. An Act to authorize the cancellation of certain Confederate States bonds, and the substitution of others for them. January 9, 1864, ch. 8 173

- Act increasing pay of certain officers, &c., at Richmond, continued in force. An Act to continue in force the provisions of an act therein named. January 13, 1864, ch. 9 173

- Elections for members of Congress in Missouri. An Act to provide for holding elections for representatives in the Congress of the Confederate States from the State of Missouri. January 19, 1864, ch. 10 173

- Procuring persons to desert from the army. An Act to prevent the procuring, aiding and assisting persons to desert from the army of the Confederate States, and for other purposes. January 22, 1864, ch. 11 174

- Appropriation for the Cherokees. An Act appropriating one hundred thousand dollars for the use and benefit of the Cherokee Nation. January 22, 1864, ch. 12 175

- Chaplains allowed to draw forage. An Act authorizing chaplains, in certain cases, to draw, forage for one horse. January 22, 1864, ch. 13 175

- Appointment of agent of the Treasury Department, west of the Mississippi. An Act to authorize the appointment of an agent of the Treasury Department west of the Mississippi. January 27, 1864, ch. 14 176

Page iv - Attorney General not required to report to Congress claims against the Confederate States. An Act to amend "An Act to provide a mode of authenticating claims for money against the Confederate States not otherwise provided for," approved August 30, 1861. January 30, 1864, ch. 15 176

- Pay of certain civil officers and employees, increased. An Act to increase the compensation of certain civil officers and employees in the President's office and in the Executive and Legislative Departments at Richmond, for a limited period. January 30, 1864, ch. 16 176

- Collection of tax in kind on tobacco. An Act to regulate the collection of the tax in kind upon tobacco, and to amend an act entitled "An Act to lay taxes for the common defence and carry on the Government of the Confederate States," approved April 24, 1863. January 30, 1864, ch. 17 177

- Indemnity to officers receiving counterfeit Treasury Notes, extended. An Act to extend the provisions of an act entitled "An Act in relation to the receipt of counterfeit treasury notes by public officers," approved May 1, 1863. January 30, 1864, ch. 18 177

- Pay and allowances of Master Armorer at Richmond. An Act to fix the pay and allowances of the master armorer of the Confederate States armory at Richmond, Virginia. January 30, 1864, ch. 19 178

- Time for assembling of Second Congress, changed. An Act to change the time for the assembling of Congress for its next regular session. February 3, 1864, ch. 20 178

- Assignment of judges of military courts. An Act to authorize the President to assign judges of military courts from one court to another. February 3, 1864, ch. 21 178

- Treasury Note Bureau, organized. An Act to organize the treasury note bureau. Feb. 3, 1864, ch. 22, 178

- Importation of luxuries prohibited. An Act to prohibit the importation of luxuries, or of articles not necessaries, or of common use. February 6, 1864, ch. 23 179

- Regulations imposed upon the foreign commerce. A bill to impose regulations upon the foreign commerce of the Confederate States to provide for the public defence. February 6, 1864, ch. 24 181

- Dealing in the paper currency of the enemy. An Act to prohibit dealing in the paper currency of the enemy. February 6, 1864, ch. 25 183

- Detail of field officers as members of military courts. An Act to authorize commanders of corps and departments to detail field officers as members of military courts, under certain circumstances. February 6, 1864, ch. 26 183

- Appointment of agent of Post-office Department, and Clerks, west of the Mississippi river. An Act to authorize the appointment of an agent of the Post-office Department, and such clerks as may be necessary to carry on the postal service in the States west of the Mississippi river. February 10, 1864, ch. 27 184

- Salary of agent of the Treasury Department west of the Mississippi river, increased. An Act to amend "An Act to authorize the appointment of an agent of the Treasury Department west of the Mississippi," approved January 27, 1864. February 11, 1864, ch. 28 184

- Pay of officers who have performed staff duty. An Act to provide compensation for officers who may heretofore have performed staff duty under orders of their superior officers. February 11, 1864, ch. 29 185

- Act establishing Volunteer Navy, amended. An Act to amend An Act entitled "An Act to establish a volunteer navy," approved April 18, 1863. February 11, 1864, ch. 30 185

- Issue of certificates for interest on fifteen million loan. An Act to authorize the issue of certificates for interest on the "fifteen million loan." February 11, 1864, ch. 31 185

- Tax-payers relieved from tax on property destroyed by order of the Government. An Act for the relief of tax-payers in certain cases. February 13, 1864, ch. 32 186

- Establishment of military court in North Carolina. An Act to amend an act entitled "An Act to organize military courts to attend the army of the Confederate States in the field, and to define the powers of said courts. February 13, 1864, ch. 33 186

- New post-routes established. An Act to establish certain post-routes therein named. February 13, 1864, ch. 34 186

- Commutation value increased of hospital rations. An Act to increase the commutation value of hospital rations. February 15, 1864, ch. 35 187

- Digest of the Laws of the Confederate States. An Act to authorize the purchase and publication of a digest of the laws of the Confederate States. February 15, 1864, ch. 36 187

- Writ of habeas corpus suspended. An Act to suspend the privilege of the writ of habeas corpus in certain cases. February 15, 1864, ch. 37 187

- Elections for members of Congress in Arkansas. An Act to provide for holding elections for representatives in the Congress of the Confederate States of America from the State of Arkansas. February 15, 1864, ch. 38 189

- Records of State Troops. An Act to aid any State in communicating with and perfecting records concerning its troops. February 16, 1864, ch. 39 190

- Allowances to officers of the Navy. An Act making allowances to officers of the navy of the Confederate States, under certain circumstances, and to amend an act entitled "An Act to provide for the organization of the navy," approved March 16, 1861. February 16, 1864, ch. 40 191

- Territory of Arizona, act to organize, amended. An Act to amend an act entitled "An Act to organize the Territory of Arizona." February 16, 1864, ch. 41 191

- Pay of certain officers of the Treasury, increased. An Act to increase the compensation of certain officers of the Treasury. February 16, 1864, ch. 42 191

- Impressments. An Act to amend "An Act to regulate impressments," approved March 26, 1863, and to repeal an act amendatory thereof, approved April 27, 1863. February 16, 1864, ch. 43 192

- Additional military courts. An Act to authorize the President to establish additional military courts. February 16, 1864, ch. 44 193

Page v - Rations and privilege of purchasing clothing, &c., allowed commissioned officers of the army. An Act to allow commissioned officers of the army rations and the privilege of purchasing clothing from the Quartermaster's Department. February 17, 1864, ch. 45 193

- Publication in public gazettes of acts of Congress, compensation for. An Act to fix the compensation for the publication in the public gazettes of the acts of Congress. February 17, 1864, ch. 46 194

- Commissary General of subsistence to provide for sustenance of prisoners of war. An Act to repeal certain portions of the act of May the 21st, 1861, relative to prisoners of war. February 17, 1864, ch. 47 194

- Furloughs and discharges in hospitals. An Act to amend "An Act regulating the granting of furloughs and discharges in hospitals," approved May 1st, 1863. February 17, 1864, ch. 48 194

- Military courts act organizing, amended. An Act to amend an act entitled "An Act to organize military courts to attend the army of the Confederate States in the field, and to define the powers of said courts," approved October 9, 1862. February 17, 1864, ch. 49 194

- Appointment of General and Lieutenant Generals. An act relating to the appointment of a general and lieutenant generals. February 17, 1864, ch. 50 195

- Articles of war, amended. An Act to amend the sixty-fifth article of war. February 17, 1864, ch. 51 195

- Impressment of meat for the army. An Act to authorize the impressment of meat for the use of the army under certain circumstances. February 17, 1864, ch. 52 196

- Additional appropriations for the support of the Government, for the fiscal year ending June 30, 1864. An Act to make additional appropriations for the support of the Government of the Confederate States of America, for the fiscal year ending June 30, 1864. February 17, 1864, ch. 53 197

- Partisan Rangers, act organizing bands of, repealed. A bill to repeal an act to organize bands of partisan rangers, approved April 31st, 1862, and for other purposes. February 17, 1864, ch. 54 202

- Auxiliary bureaus of the War Department, west of the Mississippi river. An Act to authorize the organization of auxiliary bureaus of the War Department, west of the Mississippi river. February 17, 1864, ch. 55 202

- Invalid Corps. An Act to provide an Invalid Corps. February 17, 1864, ch. 56 203

- Mileage and salary of members elect of Second Congress. An Act to authorize the payment of mileage and salary to members elect of the Second Congress of the Confederate States. February 17, 1864, ch. 57 203

- Promotion of officers, &c., for distinguished skill or valor. An Act to authorize the promotion of officers, non-commissioned officers and privates for distinguished skill or valor. Feb. 17, 1864, ch. 58 204

- Engineer Troops. An Act to amend the act entitled "An Act to provide and organize engineer troops to serve during the war," approved 20th March, 1863. February 17, 1864, ch. 59 204

- Appointment of additional number of officers, &c., in the Engineer Corps. An Act to amend the act of April 1st, 1862, and September 23d, 1862. February 17, 1864, ch. 60 204

- County of Noxubee, Mississippi, attached to Southern judicial division of said State. An Act to attach the county of Noxubee, in the State of Mississippi, to the Southern judicial division of said State. February 17, 1864, ch. 61 205

- State Tax Collectors. An Act to be entitled "An Act in relation to the qualification of State Collectors.' February 17, 1864, ch. 62 205

- Currency reduced, and a new issue authorized of notes and bonds. An Act to reduce the currency and authorize a new issue of notes and bonds. February 17, 1864, ch. 63 205

- Additional taxes levied. An Act to levy additional taxes for the common defence and support of the Government. Feb. 17, 1864, ch. 64 208

- Organization of forces for the war. An Act to organize forces to serve during the war. February 17, 1864, ch. 65 211

- Taxes. An Act to amend an act entitled "An Act to lay taxes for the common defence and carry on the Government of the Confederate States," approved April 24th. 1863. Feb. 17, 1864, ch. 66 215

- Assessment and collection of taxes, act for, amended. An Act to amend the "Act for the assessment and collection of taxes," approved May 1st, 1863. February 17, 1864, ch. 69 227

- Volunteer Navy. An Act to amend an act entitled. "An Act to amend an act entitled "An Act to establish a volunteer navy," approved 11th February, 1864. February 17, 1864, ch. 68 229

- Additional powers conferred on courts martial and military courts. An Act to confer additional powers upon courts martial and military courts February 17, 1864, ch. 69 229

- Compensation of route and special agents of the Post Office Department, increased. An Act to authorize the increase of compensation to route and special agents of the Post-Office Department. February 17, 1864, ch. 70 230

- Tobacco for the Army. An Act to provide tobacco for the army. February 17, 1864, ch. 71, 230

- Two bureaus established in connection with the agency of the treasury for the trans-Mississippi Department. An Act to be entitled An Act to establish and organize two bureaus in connection with the agency of the treasury for the trans-Mississippi Department, one of which is to be known as the bureau of the Comptroller and the other as the bureau of the Comptroller for the trans-Mississippi Department. February 17, 1864, ch. 72, 230

- Additional clerks for the Navy Department. An Act to authorize the appointment of two additional clerks for the Navy Department. February 17, 1864, ch. 73, 232

- Retiring officers of the army. An Act to provide for retiring officers of the army. February 17, 1864, ch. 74 232

- Engineer Troops. An Act to amend an act entitled "An Act to provide and organize engineer troops to serve during the war," approved March 20th, 1863. February 17, 1864, ch. 75, 233

- Ensigns in the army, office of, created. An Act creating the office of ensign in the army of the Confederate States. February 17, 1864, ch. 76, 231

- Drunkenness in the army punished. An Act to amend An Act entitled "An Act to punish drunkenness in the army," approved April 21st, 1862. February 17, 1864, ch. 77, 234

Page vi - Additional appropriations for the support of the Government for the fiscal year ending June 30, 1864. An Act supplemental to the Act entitled "An Act to make additional appropriations for the support of the Government of the Confederate States of America for the fiscal year ending. June 30, 1864. February 17, 1864, ch. 78 234

- Free Negroes and Slaves, employment of, in certain capacities. An Act to increase the efficiency of the army by the employment of free negroes and slaves in certain capacities. February 17, 1864, ch. 79, 235

Acts of the first Congress of the Confederate States.

STATUTE IV.--1863-64.

- No. 1. Compensation of the Public Printer. Joint resolution in relation to public printer. January 5, 1864, 237

- No. 2. Thanks of Congress to General Robert E. Lee and his command. Joint resolution of thanks to General Robert E. Lee, and to the officers and solders under his command. January 8, 1864, 237

- No. 3. Resolution relating to the War. Joint resolution in relation to the war. January 22, 1864, 237

- No. 4. Thanks of Congress to Major Von Borck. Joint resolution of thanks to Major Von Borck. January 30, 1864, 238

- No. 5. Salaries of Judges of District Courts of Virginia. Joint resolution in relation to the salaries of the judges of the district courts of the Confederate States for the State of Virginia. January 30, 1864, 238

- No. 6. Thanks of Congress to the Tennessee Troops. Joint resolution of thanks to the Tennessee Troops who have re-enlisted for the war. February 3, 1864, 239

- No. 7. Thanks of Congress to North Carolina Troops. Joint resolution of thanks to North Carolina Troops. February 6, 1864, 239

- No. 8. Thanks of Congress to Louisiana Troops. Joint resolution of thanks to the Troops from the State of Louisiana in the army of Tennessee. February 6, 1864, 240

- No. 9. Thanks of Congress to Alabama Troops. Joint resolution of thanks to the Alabama Troops, who have re-enlisted for the war. February 6, 1864, 240

- No. 10. Thanks of Congress to Florida Troops. Joint resolution of thanks to certain Florida Troops. February 6, 1864, 240

- No. 11. Thanks of Congress to the Officers and Troops commanded by Major General Rodes. Joint resolution of thanks to the division commanded by Major General Rodes. February 6, 1864, 241

- No. 12. Thanks of Congress to Brigadier General S. D. Ramseur's Brigade. Joint resolution of thanks to Brigadier General S. D. Ramseur's brigade of North Carolina Troops for tendering their services for the war. February 6, 1864, 241

- No. 13. Thanks of Congress to Colonel Thomas G. Lamar and Officers and Men. Joint resolution of thanks to Colonel Thomas G. Lamar and the officers and men engaged in the defence of Secessionville. February 8, 1864, 241

- No. 14. Thanks of Congress to Captain Odlum, Lieutenant Dowling, and the men under their command. Joint resolution of thanks to Captain Odlum and Lieutenant Dowling, and the men under their command, February 8, 1864, 242

- No. 15. Thanks of Congress to General Beauregard and his command. Joint resolution of thanks to General Beauregard and the officers and men of his command, for their defence of Charleston, South Carolina. February 8, 1864, 242

- No. 16. Thanks of Congress to Major General Patrick R. Cleburne and his command. Joint resolutions of thanks to Major General Patrick R. Cleburne and the men and officers under his command, for distinguished services at Ringgold Gap, in the State of Georgia, November twenty-seventh, eighteen hundred and sixty three. February 9, 1864, 242

- No. 17. Thanks of Congress to Officers, &c., of McClung's Battery. Joint resolution of thanks to the officers and men of McClung's battery. February 13, 1864, 243

- No. 18. Thanks of Congress to the Tenth Mississippi Regiment. Joint resolution of thanks to the tenth Mississippi regiment. February 13, 1864, 243

- No. 19. Subsistence allowed sick and wounded soldiers in hospitals. Joint resolution to declare the meaning of "An Act allowing hospital accommodations to sick and wounded officers." February 13, 1864, 243

- No. 20. Thanks of Congress to Virginia Troops at Drewry's Bluff. Joint resolution of thanks to the Virginia Troops stationed at Drewry's Bluff. February 15, 1864, 243

- No. 21. Thanks of Congress to the Twenty-eighth and Thirteenth Regiments of North Carolina. Joint resolution of thanks to the officers and men of the twenty-eighth and thirteenth regiments of North Carolina Troops. February 15, 1864, 244

- No. 22. Thanks of Congress to the Third Georgia Regiment. Joint resolution of thanks to the officers and men of the third Georgia regiment. February 15, 1864, 244

- No. 23. Thanks of Congress to Twenty-Second Virginia Regiment. Joint resolution of thanks to the officers and men of the twenty-second Virginia regiment. February 15, 1864, 244

- No. 24. Thanks of Congress to Hart's Battery, Hampton's Legion. Joint resolution of thanks to Hart's Battery, Hampton's Legion, South Carolina volunteers. February 15, 1864, 245

- No. 25. Thanks of Congress to the Sixteenth Mississippi Regiment. Joint resolution of thanks to the sixteenth Mississippi regiment. February 15, 1864, 245

- No. 26. Thanks of Congress to the Forty-sixth and Fifty-fifth Regiments of Tennessee Volunteers. Joint resolution of thanks to the forty-sixth and fifty-fifth regiments of Tennessee volunteers, at Mobile. February 15, 1864, 245

Page vii - No. 27. Thanks of Congress to Alabama Soldiers, Joint resolution of thanks to the soldiers from the State of Alabama who have re-enlisted for the war. February 15, 1864, 245

- No. 28. Thanks of Congress to the Seventh and Twelfth Virginia Regiments. Joint resolution of thanks to the officers and men of the seventh and twelfth regiments Virginia Troops. February 15, 1864, 246

- No. 29. Thanks of Congress to Lomax's Brigade. Joint resolution of thanks to the officers and men of Lomax's brigade. February 15, 1864, 246

- No. 30. Thanks of Congress to Georgia Troops. Joint resolution of thanks to the troops re-enlisting for the war from the State of Georgia. February 15, 1864, 246

- No. 31. Thanks of Congress to certain Virginia Regiments. Joint resolution of thanks to certain Virginia regiments who have re-enlisted for the war. February 15, 1864, 246

- No. 32. Thanks of Congress to Commander John Taylor Wood and his command. Joint resolution of thanks to Commander John Taylor Wood and the officers and men under his command, for daring and brilliant conduct. February 15, 1864, 247

- No. 33. Thanks of Congress to certain North Carolina Regiments. Joint resolution of thanks to the fifteenth, twenty-seventh and thirtieth regiments of North Carolina Troops for their patriotic devotion in re-enlisting for the war. February 15, 1864, 247

- No. 34. Thanks of Congress to Douglas' (Texas) Battery. Joint resolution of thanks to the enlisted men of Douglas' (Texas) Battery. February 16, 1864, 247

- No. 35. Thanks of Congress to certain North Carolina Regiments. Joint resolution of thanks to the fifteenth and twenty-seventh regiments of North Carolina Troops, Cooke's brigade. February 16, 1864, 247

- No. 36. Thanks of Congress to Ninth Alabama Regiment. Joint resolution of thanks to the Ninth Alabama regiment. February 16, 1864, 248

- No. 37. Thanks of Congress to Lieutenant General E. Kirby Smith and his Command. Joint resolution of thanks to Lieutenant General E. Kirby Smith, for the battle of Richmond, Kentucky, and to his Lieutenants, so specially commended by him, and to all the officers and soldiers of his command in that battle. February 17, 1864, 248

- No. 38. Thanks of Congress to Poague's Artillery Battalion. Joint resolution of thanks to the officers and men of Poague's artillery battalion, for re-enlisting during the war. February 17, 1864, 249

- No. 39. Thanks of Congress to the Pee Dee Artillery. Joint resolution of thanks to the Pee Dee Artillery of South Carolina volunteers. February 17, 1864, 249

- No. 40. Thanks of Congress to McGowan's Brigade. Joint resolution of thanks to the officers and men of McGowan's brigade, consisting of Orr's rifles, the first, twelfth, thirteenth and fourteenth regiments of South Carolina volunteers. February 17, 1864, 249

- No. 41. Thanks of Congress to General N. B. Forrest and his command. Resolution of thanks to General N. B. Forrest and the officers and men of his command. February 17, 1864, 250

- No. 42. Thanks of Congress to Lieutenant General Longstreet. Joint resolution of thanks to Lieutenant General Longstreet and the officers and men of his command. February 17, 1864, 250

- No. 43. Soldiers detailed for clerical duty in Richmond, allowed the increased compensation of civil officers and employees in the departments at Richmond. Joint resolution construing an "Act to increase the compensation of civil officers and employees in the President's office and the Executive and Legislative Departments at Richmond, for a limited period," approved January thirtieth, eighteen hundred and sixty-four. February 17, 1864, 250

- No. 44. Thanks of Congress to Major General J. E. B. Stewart and his command. Joint resolution of thanks to Major General J. E. B. Stewart and the officers and men under his command. February 17, 1864, 250

- No. 45. Thanks of Congress to thirty-seventh Mississippi Regiment. Joint resolution of thanks to the thirty-seventh Mississippi regiment. February 17, 1864, 251

- No. 46. Address to the people, adoption and publication of. Joint resolution in reference to the adoption and publication of an address to the people of the Confederate States. February 17, 1864, 251

- No. 47. Thanks of Congress to Thirty-seventh North Carolina Regiment. Joint resolution of thanks to the officers and men of thirty-seventh regiment of North Carolina Troops. February 17, 1864, 251

- No. 48. Daily wages of soldiers and employees of the Government exempted from taxation. Joint resolution explanatory of the Act entitled "An Act to lay taxes for the common defence and carry on the Government," approved the twenty-fourth day of April, eighteen hundred and sixty-three. February 17, 1864, 251

- No. 49. Thanks of Congress to the Surry Light Artillery. Joint resolution of thanks to the Surry Light Artillery. February 17, 1864, 252

PUBLIC RESOLUTIONS.

Page viii

| Page. | Ch. | Sec. | Line. | |

| 181 | 24 | 9 | For "consigners," (in side note,) read "consignees." | |

| 184 | 27 | For "1863," (in side note,) read "1864." | ||

| 194 | 46 | For "2864," (in side note,) read "1864." | ||

| 194 | 49 | For "way," (in side note,) read "army." | ||

| 250 | Res. 43, | 1 | For "Thar," read "That." |

Page 171

PUBLIC ACTS OF THE FIRST CONGRESS

OF THE

CONFEDERATE STATES,

Passed at the fourth session, which was begun and held at the city of Richmond, in the State of Virginia, on Monday, the seventh day of December, A. D., 1863, and ended on Thursday, the eighteenth day of February, 1864.

JEFFERSON DAVIS, President. ALEXANDER H. STEPHENS, Vice-President, and President of the Senate. THOMAS S. BOCOCK, Speaker of the House of Representatives.

CHAP. I.--An Act to amend so much of section eleven of the Tax Law as requires one-tenth

the Sweet Potatoes produced this year to be paid to the Government.

Dec. 28, 1863.

See ante, ch. 38, 11, p, 122.

Producers of sweet potatoes, in the year 1863 authorized to make commutation by payment of the money value of the tithe thereof, instead of payment in kind.

The Congress of the Confederate States of America do enact, That so much of section eleven of "An act to lay taxes for the common defence, and carry on the Government of the Confederate States," approved April twenty-fourth, eighteen hundred and sixty-three, as requires farmers and planters to pay one-tenth of the sweet potatoes produced in the present year to the Confederate Government, be so amended as to authorize the producers of sweet potatoes, in the year eighteen hundred and sixty-three, to make commutation by payment of the money value of the tithe thereof, instead of payment in kind, at rates to be fixed by the commissioners under the impressment act.

APPROVED December 28, 1863.

CHAP. II.--An Act authorizing the tax in kind on bacon to be commuted by collection of

salt pork as an equivalent.

Dec. 28, 1863.

Salt pork received in commutation for the tax in hind on bacon.

The Congress of the Confederate States of America do enact, That assistant quartermasters and other agents engaged in the collection of tax in kind may be authorized, under orders and regulations made by the Secretary of War, to demand and receive, in commutation for the tax in kind on bacon, an equivalent therefor in salt pork.

APPROVED December 28, 1863.

Page 172

CHAP. III.--An Act to prevent the enlistment or enrollment of substitutes in the military

service of the Confederate States.

Dec. 28, 1863.

Persons liable to military service not allowed to furnish substitutes.

The Congress of the Confederate States of America do enact, That no person liable to military service shall hereafter be permitted or allowed to furnish a substitute for such service, nor shall any substitute be received, enlisted or enrolled in the military service of the Confederate States.

APPROVED December 28, 1863.

CHAP. IV.--An Act to put an end to the exemption from military service of those who

have heretofore furnished substitutes.

Jan. 5, 1864.

WHEREAS, in the present circumstances of the country, it requires the aid of all who are able to bear arms; [Therefore]--

No person exempted from military service by reason of having furnished a substitute.

The Congress of the Confederate States of America do enact, That no person shall be exempted from military service by reason of his having furnished a substitute; but this act shall not be so construed as to affect persons who, though not liable to render military service, have, nevertheless, furnished substitutes.

APPROVED January 5, 1864.

CHAP. V.--An Act providing for filling vacancies of delegates to Congress in certain

Indian nations.

Jan. 5, 1864.

Vacancies in the representation of any Indian nation in Congress, filled by special election. How election to be held and conducted.

1863, May 1.

The Congress of the Confederate States of America do enact, That whenever, by any cause, a vacancy shall occur in the representation of any Indian nation entitled to a delegate in the Confederate Congress, the same shall be filled by special election, after thirty days' notice of said election, to be held and conducted according to the provisions of an act of Congress, entitled "An act to provide certain regulations for holding elections for delegates to the Congress of the Confederate States in certain Indian nations," approved May first, eighteen hundred and sixty-three; said notice to be given by the Governor or principal chief of such nation, according to the usual mode of giving notices by such nation or nations.

When this act to take effect.

SEC. 2. That this act take effect and be in force from and after its passage.

APPROVED January 5, 1864.

CHAP. VI.--An Act to continue in force an act entitled "An act to provide for the compensation of certain persons therein, named," approved May the first, eighteen hundred and sixty-three.

Jan. 6, 1864.

(See ante, ch. 72, p. 155.)

Act of 1863, May 1, providing for the pay of non-commissioned officers, &c., on detailed or detached service, continued in force till January 1, 1865.

The Congress of the Confederate States of America do enact, That the act entitled "An act to provide for the compensation of certain persons therein named," approved May the first, eighteen hundred and sixty-three, which, by its own limitation, would expire on the first of January, eighteen hundred and sixty-four, be, and the same is hereby

Page 173

continued in force until the first of January, eighteen hundred and sixty-five.

APPROVED January 6, 1864.

CHAP. VII.--An Act to authorize the appointment of a Third Auditor of the Treasury.

Jan. 8, 1864.

Appointment of a Third Auditor of the Treasury.

His duties.

Salary.

The Congress of the Confederate States of America do enact, That there shall be appointed by the President, by and with the advice and consent of the Senate, an Auditor of the Treasury for the Post-office Department, who shall be styled the Third Auditor, and who shall be charged with all the duties connected with the Post-office Department which the First Auditor is now required to perform, who shall receive for his services a salary of three thousand dollars per annum.

APPROVED January 8, 1864.

CHAP. VIII.--An Act to authorize the cancellation of certain Confederate States bonds,

and the substitution of others for them.

Jan. 9, 1864.

On cancellation abroad of certain bonds for $1,000,000 each, issued to the Secretary of the Navy, other bonds to be substituted.

The Congress of the Confederate States of America do enact, That the Secretary of the Treasury be, and he is hereby, authorized, upon the receipt of satisfactory evidence that the eight per centum bonds issued by him upon the requisitions of the Secretary of the Navy, dated October the eighteenth and twenty-seventh, eighteen hundred and sixty-two, for one million of dollars each, have been cancelled abroad, to substitute and deliver to the Secretary of the Navy an equal number of bonds of like character.

APPROVED January 9, 1864.

CHAP. IX.--An Act to continue in force the provisions of an act therein named.

Jan. 13, 1864.

Act of 1862, Oct. 13, (see ante, ch. 47, p. 80,) increasing the pay of certain officers, &c., continued in force.

The Congress of the Confederate States of America do enact, That the provisions of an act entitled "An act to increase the pay of certain officers and employees of the Executive and Legislative Departments," approved October thirteenth, eighteen hundred and sixty-two, be, and the same are hereby, continued in force until otherwise ordered by Congress.

APPROVED January 13, 1864.

CHAP. X.--An Act to provide for holding elections for representatives in the Congress of

the Confederate States from the State of Missouri.

Jan. 19, 1864.

Elections for representatives in Congress for the State of Missouri.

Representatives elected to be commissioned by the Governor.

The Congress of the Confederate States of America do enact, That elections for representatives in the Congress of the Confederate States for the State of Missouri may be held as follows, until the Legislature of said State shall otherwise direct: That each voter shall be allowed to vote one ticket, containing the name of one person for each one of the seven congressional districts of said State, and the persons receiving the highest

Page 174

number of votes for the representative districts, shall be commissioned as representatives by the Governor of said State.

When election to be held.

SEC. 2. Such election shall be held upon the first Monday in May next, and upon the same day of each second year thereafter during the war.

By what officers, and how conducted

SEC. 3. Such elections shall be held by the officers authorized, or persons appointed or provided by the laws of said State for the purpose of holding such elections, and shall be conducted according to the mode prescribed by the laws of said State, except so far as the same are modified by this act.

Qualification of voters.

SEC. 4. In such elections, any citizen of the Confederate States who shall be qualified to vote for a member of the most numerous branch of the State Legislature of said State, shall be entitled to vote at the place or places in said State, at which he would be entitled to vote in an election for such member of said Legislature.

When citizens allowed to vote at any place of voting in said State or in the camps of the army.

SEC. 5. But in case such citizen shall be in the military service of the Confederate States, or in case he shall be driven from his home by the occupation of his country by the public enemy, or by the movements of the enemy's troops, or in case the election cannot be held at the usual places of holding the same, by reason of such occupation or movements, then such citizen shall be allowed to vote at any place of voting in said State, or in the camps of the army, as hereinafter provided.

How election conducted when held in the camps of the army.

SEC. 6. Such elections for representatives, when held in the camps of the army, shall be conducted as follows: In every army corps, division, or command, the colonel of each regiment, or other officer in command of any less body on detached service, shall appoint two judges and three clerks to open and hold such election, who shall hold the same and make out the poll-books and returns, under the same rules and regulations, as far as practicable, as if the same were opened and held at the usual places of holding the same in said State, and shall allow all persons entitled, to vote therein.

Returns of such elections in camps.

SEC. 7. The returns of such elections in camps shall be forwarded by the several commanding officers, appointing the judges and clerks as aforesaid, to the highest officer in grade, and the senior of the grade from said State, for which the same is held in the encampment or army, in which the same is held, whose duty it shall be, at once, to forward the same to the Governor of the State, or the same may be, if more convenient, forwarded by such commanding officer directly to the Governor.

When elections in camps may be held.

SEC. 8. In case the exigencies of the public service prevent the holding of the elections in any camp under this act, at the time provided by law, the same may be held at any time within ten days after the preventing cause may cease; the time for holding the same to be fixed by the officer authorized to appoint the judges and clerks.

Oaths of judges and clerks, by whom administered.

SEC. 9. Such officer shall be authorized to administer the proper oaths to the judges and clerks, or they may administer the same to each other.

Oath of persons concerned in holding such election.

SEC. 10. Every person concerned in holding such election shall take an oath to support the Constitution of the Confederate States, and to discharge his duty, in holding such election, faithfully and impartially.

APPROVED January 19, 1864.

CHAP. XI.--An Act to prevent the procuring, aiding, and assisting persons to desert

from the army of the Confederate States, and for other purposes.

Jan. 22, 1864.

Procuring, aiding and assisting persons to desert from the army.

Concealing or harboring deserters.

Purchasing from a soldier his arms, &c., or property belonging to the C. S., or any officer or soldier.

Penalty.

The Congress of the Confederate States of America do enact, That every person not subject to the rules and articles of war, who shall procure

Page 175

or entice a soldier or person enrolled for service in the army of the Confederate States to desert; or who shall aid or assist any deserter from the army, or any person enrolled for service, to evade their proper commanders, or to prevent their arrest to be returned to the service; or who shall knowingly conceal or harbor any such deserter; or shall purchase from any soldier or person enrolled for service any portion of his arms, equipments, rations or clothing, or any property belonging to the Confederate States or any officer or soldier of the Confederate States, shall, upon conviction before the District Court of the Confederate States, having jurisdiction of the offence, be fined not exceeding one thousand dollars, and be imprisoned not exceeding two years.

APPROVED January 22, 1864.

CHAP. XII.--An Act appropriating one hundred thousand dollars for the use and

benefit of the Cherokee Nation.

Jan. 22, 1864.

Preamble.

WHEREAS, by the forty-fifth article of the treaty between the Confederate States of America and the Cherokee Nation, the said Confederate States promised to collect and pay over to the Cherokee Nation the annual interest upon the several sums of money invested by said nation in stocks of certain States of the Confederate States; and whereas, by reason of the war with the United States, it is impracticable to make such collection; and whereas, there is good reason to believe that the citizens of said nation are greatly in need of the money thus due them: Therefore,

Appropriation of $100,000 for the Cherokee Nation.

The Congress of the Confederate States of America do enact, That the sum of one hundred thousand dollars be, and the same is hereby, appropriated out of any money in the treasury, not otherwise appropriated, for the use and benefit of the Cherokee Nation.

Bureau of Indian Affairs to forward the money.

SEC. 2. The said sum of money shall be forwarded without delay by the Bureau of Indian Affairs to the proper representatives of the Cherokee Nation.

Cherokee Nation to return the same, or the C. S. to be reimbursed out of the interest on certain stocks.

SEC. 3. It is hereby expressly understood that said one hundred thousand dollars is to be returned by the said Cherokee Nation when peace shall be ratified between the United and Confederate States, or that the said Confederate States shall be reimbursed out of the interest on said stocks which may then be due and collected.

APPROVED January 22, 1864.

CHAP. XIII.--An Act authorizing chaplains, in certain cases, to draw forage for one

horse.

Jan. 22, 1864.

Chaplains in the army entitled to forage for one horse.

Proviso.

The Congress of the Confederate States of America do enact, That chaplains in the army, in actual service in the field, shall be entitled to draw forage for one horse: Provided, The chaplain has a horse in his use.

APPROVED January 22, 1864.

Page 176

CHAP. XIV.--An Act to authorize the appointment of an agent of the Treasury Department

west of the Mississippi.

Appointment of agent of the Treasury Department, west of the Mississippi.

Salary.

The Congress of the Confederate States of America do enact, That the President shall, by and with the advice and consent of the Senate, appoint an agent of the Treasury Department, whose duty it shall be to reside west of the Mississippi, at such place, and to discharge such duties, as shall, from time to time, be assigned him by the Secretary of the Treasury, with a salary of three thousand dollars per annum, payable quarterly, in advance.

Duties.

Clerks.

Regulations for the Government of agent and clerks.

Salaries of clerks.

SEC. 2. The Secretary of the Treasury shall have power to give direction to the said agent to discharge any duty or function on the other side of the Mississippi which he, the said Secretary, is competent to discharge; and shall also have power to authorize the employment of such clerks, and to prescribe such regulations for the government of such agent and clerks as, from time to time, the said Secretary may deem proper: Provided, That such clerks shall receive the salaries provided by law for similar services in the Treasury Department.

When this act to expire.

SEC. 3. That this act shall expire on the day of the ratification of a treaty of peace between the Confederate States and the United States of America.

APPROVED January 27, 1864.

CHAP XV.--An Act to amend "An Act to provide a mode of authenticating claims for

money against the Confederate States not otherwise provided for," approved August

30, 1861.

Jan. 30, 1864.

Act of Aug. 30, 1861, §1, requiring the Attorney General to report to Congress claims against C. S., repealed.

The Congress of the Confederate States of America do enact, That so much of the first section of said act as requires the Attorney General to report to Congress upon said claims be, and the same is hereby, repealed.

APPROVED January 30, 1864.

CHAP. XVI.--An Act to increase the compensation of certain civil officers and employees

in the President's office and in the Executive and Legislative Departments, at Richmond,

for a limited period.

Jan. 30, 1864.

Salaries of civil officers and employees in the President's office and in the Executive and Legislative Departments at Richmond, increased.

Proviso.

The Congress of the Confederate States of America do enact, That the salaries and compensation of all civil officers and employees in the President's office, and in the Executive and Legislative Departments, at Richmond, whose compensation or salaries do not exceed the sum of two thousand dollars per annum, shall be increased from the passage of this act to the fifteenth of May, eighteen hundred and sixty-four, at the rate of one hundred per cent. per annum: Provided, The same shall not thereby be increased beyond the rate of three thousand dollars per annum; and the salaries of all said officers whose compensation is above two thousand dollars, and does not exceed the sum of three thousand dollars per annum, shall, for the same period of time, be increased at the rate of fifty per cent. per annum; but it is hereby expressly declared that the increased compensation provided for in this act, shall not be paid to any officer or employee in any executive department of the Government, who is liable to perform military duty, or is able to bear arms in the field, unless such officer or employee shall first obtain a certificate from the head of the department in which he is engaged, that his services are absolutely necessary to the Government, and that his place

Page 177

cannot be supplied by any one known to the head of the department who is not subject to military duty, which said certificate shall be field with the Secretary of the Treasury before the money is paid; and it shall be the duty of the said Secretary, at the beginning of each session, to communicate a list of all such certificates to Congress: Provided, That no clerk who, by virtue of a military commission, receives rations or commutation of rations, shall be entitled to the benefit this act.

APPROVED January 30, 1864.

CHAP. XVII.--An Act to regulate the collection of the tax in kind upon tobacco, and to

amend an act entitled "An Act to lay taxes for the common defence and carry on the

Government of the Confederate States," approved April 24, 1863.

Jan. 30, 1864.

Tax in kind on tobacco to be collected by agents.

Tax assessors to transfer their estimates to the agents, and copy of estimates to Produce Loan office.

The Congress of the Confederate States of America do enact, That the tax in kind of one-tenth imposed by said act upon all tobacco grown in the Confederate States, instead of being collected by the post quartermaster, shall be collected by the agents appointed by the Secretary of the Treasury to collect and preserve tobacco, and the tax assessors shall transfer their estimates of the tobacco, due from each planter or farmer, specifying both quantity and quality, to the said agents or their duly authorized sub-agents, taking their receipts therefor, and shall also transmit a copy of these estimates to the Chief of the Produce Loan office; and when said tobacco shall have been collected, the said agents shall be liable for its safe custody.

When and where tithe of tobacco to be delivered, and in what order.

Prizing depots to be established.

SEC. 2. That each farmer and planter, not earlier than the first day of June, nor later than the fifteenth day of July, shall deliver his tithe of tobacco in prizing order, put up in convenient parcels for transportation, at the nearest prizing depot, of which there shall be not less than one established in each county by the agents for the collection and preservation of tobacco, where the said tobacco shall be prized and securely packed in hogsheads or other packages, suitable for market, by said agents.

Statement required of different qualities of tobacco.

Assessment and delivery of one-tenth thereof.

SEC. 4. That the tax assessor shall require a statement from each farmer or planter as to the different qualities of tobacco raised by him, and shall assess, as due the Confederate States, one-tenth of each of said qualities, which shall be stated separately in his estimates, and shall be delivered separately by the farmer or planter at the prizing depots.

Acts repealed.

SEC. 4. All acts and parts of acts, inconsistent with the foregoing, are hereby repealed.

APPROVED January 30, 1864.

CHAP. XVIII.--An Act to extend the provisions of an act entitled "An Act in relation to the receipt of Counterfeit Treasury Notes by public officers," approved May 1, 1863.

Jan. 30, 1864.

Acts of May 1, 1863, (see ante. p. 160, ch. 83,) in relation to the receipt of counterfeit treasury notes by public officers, extended to Jan. 1, 1864.

The Congress of the Confederate States of America do enact, That the provisions of an act entitled "An Act in relation to the receipt of Counterfeit Treasury Notes by public officers," approved May first, one thousand eight hundred and sixty-three, be, and the same are hereby extended, so as to embrace all counterfeit treasury notes received by the public officers mentioned in said act, prior to the first day of January, in the year eighteen hundred and sixty-four.

APPROVED January 30, 1864.

Page 178

CHAP. XIX.--An Act to fix the pay and allowances of the Master Armorer of the Confederate

States Armory at Richmond, Virginia.

Jan. 30, 1864.

Salary and allowances of the master armorer of the C. S. Armory, Richmond.

The Congress of the Confederate States of America do enact, That the Master Armorer of the Confederate States Armory at Richmond, Virginia, shall hereafter receive a salary of three thousand dollars per annum from the time of the passage of this act, with allowances for quarters and fuel, of a captain of infantry.

APPROVED January 30, 1864.

CHAP. XX.--An Act to change the time for the assembling of Congress for its next regular

session.

Feb. 3, 1864.

Next regular session of Congress to be on the first Monday in May, 1864.

The Congress of the Confederate States of America do enact, That the Congress of the Confederate States of America, for its next regular session, shall assemble the first Monday in May, Anno Domini, eighteen hundred and sixty-four, and not the first Monday of December, eighteen hundred and sixty-four.

APPROVED February 3, 1864.

CHAP. XXI.--An Act to authorize the President to assign judge of military courts from

one court to another.

Feb. 3, 1864.

President may assign judges from one military court to another.

The Congress of the Confederate States of America do enact, That the President be, and he is hereby, authorized, at any time, to assign judges from one military court to another, as, in his judgment, the service may require.

Act to take effect from its passage.

SEC. 2. Be it further enacted, That this act take effect and be in force from and after its passage.

APPROVED February 3, 1864.

CHAP. XXII.--An Act to organize the Treasury Note Bureau.

Feb. 3, 1864.

Treasury note bureau to be organized.

The Congress of the Confederate States of America do enact, That another bureau shall be organized in the Treasury Department, to be known as the Treasury Note Bureau, which shall have charge of the engraving, printing and preparing of treasury notes and bonds, and of every thing incidental thereto.

Appointment of chief of bureau.

Salary.

Duties.

SEC. 2. A chief of the said bureau shall be appointed by the President, by and with the advice and consent of the Senate, with the same salary as the other heads of bureaus in the said Department, whose duty it shall be to provide the materials necessary for every issue of notes or bonds, and to cause the said notes and bonds to be engraved, printed and prepared for issue, and to superintend and have in charge all the clerks employed in and about the said bureau, under the direction and control of the Secretary of the Treasury.

Chief clerks.

Messengers and clerks.

Their salaries.

SEC. 3. The Secretary of the Treasury may appoint a chief clerk of the said bureau, to reside at Columbia during such time as the engraving and printing may be conducted there, and another chief clerk at Richmond; also, two messengers and as many clerks, male and female, as may be necessary to conduct the business of the bureau. The chief clerk at Columbia

Page 179

shall receive a salary of twenty-five hundred dollars per annum, payable quarterly, and the other clerks and the messengers shall receive the same salaries as are provided by law for the clerks of the same grade at Richmond.

Regulations for gsvernment of bureau.

SEC. 4. The Secretary of the Treasury shall establish regulations for the government and management of the said bureau and for securing such safeguards against counterfeit notes, bonds or coupons, as he may deem expedient.

APPROVED February 3, 1864.

CHAP. XXIII.--An Act to prohibit the importation of luxuries, or of articles not necessaries

or of common use.

Feb. 6, 1864.

The importation of certain articles specified in schedule A and B of the act of May 21, 1861,

The Congress of the Confederate States of America do enact, That from and after the first day of March next it shall not be lawful to import into the Confederate States any brandy, wines, or other spirits, or any other article specified in schedule A of an act entitled "An act to provide revenue from commodities imported from foreign countries," approved May twenty-first, eighteen hundred and sixty-one, or any goods, wares or merchandise, enumerated in schedule B of said act, except the following articles: All things for medicinal purposes, camphor refined, pickles, molasses, pepper, pimento, cloves, nutmegs, cinnamon, and all other spices; soap, castile, Windsor, and all other toilet soaps; sugar of all kinds; syrup of sugar; galloons, laces, knots, stars, tassels, tresses and wings of gold and silver, or imitations thereof, intended for uniforms of officers in the military or naval service.

and in schedule C,

SEC. 2. And it shall not be lawful to import the following articles, enumerated in schedule C of said act: Beer, ale and porter; muffs and tippets, and all other manufactures of fur, or of which fur shall be a component part, except caps and hats; carpets, carpetings, hearth rugs, bedsides and other portions of carpeting of any kind or description; carriages and parts of carriages; cider and other beverages not containing alcohol; clocks and parts of clocks; cotton laces, cotton insertings, cotton trimmings, or laces of thread or other material; coral, manufactured; dolls and toys of all kinds; fire-crackers, sky-rockets, Roman candles and all similar articles used in pyrotechnics; furniture, cabinet and household; glass, colored, stained or painted; India matting of all sorts; jet and manufactures of jet, and imitations thereof; jewelry, or imitations thereof; manufactures and articles of marble, marble paving tiles, slabs or blocks, and all other marble; matting, China or other floor matting and mats made of flags, jute or grass; paper hangings, paper for walls, and paper for screens or fire-boards; paving and roofing tiles and bricks, and roofing slates and fire-bricks; thread lacings and insertings; velvets of all kinds.

and D and E of the said act, prohibited.

SEC. 3. And it shall not be lawful to import the following articles, enumerated in schedule D of said act: Angora, Thibet and other goats' hair, or mohair, unmanufactured; bananas, cocoa nuts, plaintains and oranges; cabinets of coins, medals, gems and collections of antiquities; diamonds, mosaics, gems, pearls, rubies, and other precious stones and imitations thereof, set in gold or silver or other metals; engravings bound or unbound; rattans and reeds; paintings and statuary; leaf and unmanufactured tobacco and cigars; or the following articles enumerated in schedule E: diamonds, cameos, mosaics, pearls, gems, rubies and other precious stones and imitations thereof, when not set.

Manufactures of metal designed as ornaments, not admitted.

Secretary of Treasury to prescribe maximum forelgn prices at and within which importations of goods made of cotton, flax, wool, &c., may be made.

Proviso.

Further proviso.

Further proviso.

SEC. 4. None of the manufactures of metal, designed as either household

Page 180

hold or personal ornaments, shall be admitted; and in order to confine importations to articles of necessity and of common use, the Secretary of the Treasury shall prescribe the maximum foreign prices at which and within which importations of goods manufactured wholly or partly of cotton, flax, wool, or of silk, and designed for wearing apparel, and not herein prohibited, may be made, and beyond which importations thereof shall not be made: Provided, That articles herein allowed to be imported shall not be impressed by the Government or its agents after they have reached the Confederate States: Provided further, That nothing herein contained shall be construed to prohibit any importation for the use or account of the Confederate States, or either of them: Provided further, That this act shall not apply to any article or articles which have been or shall be shipped without knowledge of the passage of this act, before the first day of March next, but which shall arrive in a Confederate port after that day.

Articles imported in violation of this act, and the ship, vessel, &c., in which imported, forfeited.

Owner to forfeit and pay double the value of such articles.

SEC. 5. That whenever any article or articles, the importation of which is prohibited by this act, shall, after the first day of March next, be imported into the Confederate States, contrary to the true intent and meaning of this act, or shall, after said first day of March next, be put on board any ship or vessel, boat, raft or carriage, with the intention of importing the same into the Confederate States, all such articles, as well as all other articles on board the same ship or vessel, boat, raft or carriage, belonging to the owner of such prohibited articles, shall be forfeited, and the owner thereof shall, moreover, forfeit and pay double the value of such articles.

Penalty for importing or landing any of the articles prohibited omitted in the manifest or entry, or without permit.

SEC. 6. If any article or articles, the importation of which is prohibited by this act, shall, nevertheless, be on board any ship or vessel, boat, raft or carriage, arriving after said first day of March next in the Confederate States, and shall be omitted in the manifest, report or entry of the master, or the person having the charge or command of such ship or vessel, boat, raft or carriage, or shall be omitted in the entry of the goods owned by the owner, or consigned to the consignee of such articles, or shall be imported or landed, or attempted to be imported or landed, without a permit, the same penalties, fines and forfeitures shall be incurred, and may be recovered as in the case of similar omission or omissions, landing, importation, or attempt to land or import, in relation to articles liable to duties on their importation into the Confederate States.

Offices of the customs may seize goods imported contrary to this act.

Penalty for concealing or buying any such goods.

SEC. 7. Every collector, naval officer, surveyor, or other officer of the customs, shall have the like power and authority to seize goods, wares and merchandise imported contrary to the intent and meaning of this act, to keep the same in custody until it shall have been ascertained whether the same have been forfeited or not, and to enter any ship or vessel, dwelling-house, store, building or other place, for the purpose of searching for and seizing any such goods, wares and merchandise which he or they now have by law, in relation to goods, wares and merchandize, subject to duty; and if any person or persons shall conceal or buy any goods, wares or merchandize, knowing them to be liable to seizure by this act, such person or persons shall, on conviction thereof, forfeit and pay a sum double the amount or value of the goods, wares and merchandise so concealed or purchased.

Additional oath required of masters of vessels.

SEC. 8. The following additional oath or affirmation shall be taken by masters or persons having charge or command of any ship or vessel arriving at any port of the Confederate States after said first day of March next, viz: "I further swear (or affirm) that there are not, to the best of my knowledge and belief, on board [insert the denomination and name of the vessel] any goods, wares or merchandise, the importation of which into the Confederate States is prohibited by law; and I do further swear (or affirm) that if I shall hereafter discover or know of any such goods, wares or merchandise, on board of the said vessel, or which shall have been

Page 181

imported in the same, I will immediately, and without delay, make due report thereof to the collector of the port of this district."

Additional oath required of importers, consignors or agents.

SEC. 9. After said first day of March next, importers, consignees or agents, at the time of entering goods into the Confederate States, shall take the following additional oath, viz: "I also swear (or affirm) that there are not, to the best of my knowledge and belief, amongst the said goods, wares or merchandise, imported or consigned as aforesaid, any goods, wares or merchandise, the importation of which into the Confederate States is prohibited by law; and I do further swear (or affirm) that if I shall hereafter discover any such goods, wares or merchandise, among the said goods, wares and merchandise imported or consigned as aforesaid, I will immediately and without delay report the same to the collector of this district."

Penalties and forfeitures, how sued for and recovered; how mitigated and remitted.

SEC. 10. All penalties and forfeitures arising under this act, may be sued for and recovered, and shall be distributed and accounted for, in the manner prescribed by the act entitled "An act to regulate the collection of the duties on imports and tonnage;" and such penalties and forfeitures may be examined, mitigated or remitted, in like manner and under the like conditions, regulations and restrictions as are prescribed, authorized and directed, by the act entitled, "An act to provide for mitigating or remitting the forfeitures, penalties and disabilities accruing in certain cases therein mentioned."

When this act to expire.

SEC. 11. That this act shall expire on the day of the ratification of a treaty of peace with the United States.

APPROVED February 6, 1864.

CHAP. XXIV.--A bill to impose regulations upon the foreign commerce of the Confederate

States to provide for the public defence.

Feb. 6, 1864.

Preamble.

WHEREAS, the Confederate States are engaged in a war, upon the successful issue of which depend the integrity of their social system, the form of their civilization, the security of life and property within their limits as well as their existence as sovereign and independent States: And whereas, the condition of the contest demands that they should call into requisition whatever resources of men and money they have, for the support of their cause, and to faithfully administer the same: Therefore as a part of the system of the public defence--

Exportation of cotton, tobacco, &c., prohibited.

The Congress of the Confederate Statee of America do enact, That the exportation of cotton, tobacco, military and naval stores, sugar, molasses and rice from the Confederate States, and from all places in the occupation of their troops, is prohibited, except under such uniform regulations as shall be made by the President of the Confederate States.

Penalty.

SEC. 2. That if any person or persons shall put, place or load, on board any ship, steamboat, or vessel, or any other water craft, or into any wagon, cart, carriage, or other vehicle for conveyance or transportation beyond the Confederate States, or into any portion of the said States occupied by the enemy, any of the articles mentioned in the first section of this act, or shall collect the same for the purpose of being conveyed or transported, contrary to the prohibition aforesaid, within the Confederate States or beyond them, the said articles, and the ship, boat, or other water craft, wagon, cart, carriage, or other vehicle, with the slaves and animals that may be employed or collected for the purpose of aiding therein, shall be forfeited, and all persons, their aiders and abettors, on conviction of being interested or concerned in the enterprise, shall be deemed to be guilty of a high misdemeanor, and punishable by such fine or imprisonment, or both, as the court may impose.

Page 182

Permit required before putting on board any ship, vessel, &c., any of the articles prohibited.

Bond.

SEC. 3. That it shall not be lawful to put on board any ship, boat, vessel or other water craft, or upon any wagon, cart, carriage, or other vehicle for transportation or conveyance as aforesaid, any of the articles aforesaid, unless a permit be previously obtained from some officer of the Confederate States, specially authorized to grant the same, particularly describing the articles thus to be laden, and the ship, boat, vessel, water craft, wagon, carriage, cart, or other vehicle, on which the same is to be transported, and until bond shall be given that the same shall be conveyed and transported to the place of destination, under such conditions and regulations, and for such objects as shall be prescribed by the President under the first section of this act.

Power given to collectors and other officers to take any of the articles in their custody.

Not to permit the same to be removed until bond shall be given.

SEC. 4. That the collectors of all the districts of the Confederate States, and such other officers as may be designated by the President of the Confederate States, shall have power and authority to take into their custody any of the articles before mentioned, found on any ship, boat, or other water craft, when there is reason to believe that they are intended for exportation, or when in vessels, carts, or wagons or any other carriage or vehicle whatsoever, or, in any manner, apparently on their way towards the territories of a foreign nation, or towards the territory of the Confederate States in the occupancy of the United States, or the vicinity thereof, or towards a place whence such articles are intended to be exported, and not to permit the same to be removed until bond shall be given, with satisfactory sureties, that no violation of this act, and the regulations under the same, is intended.

Powers given to revenue and other officers, to be exercised in conformity with instructions.

In actions against officers or their agents, they may plead the general issue.

When absolved from responsibility

Redress given to persons aggrieved.

The C. S. may export any of the articles enumerated.

SEC. 5. That the powers granted by this act to the revenue or other officers of the Confederate States under this act to allow or refuse exportation of the articles before mentioned, or for the seizure or detention of any of the said articles, shall be exercised in conformity with such instructions as the President may give through the Departments of War and of the Treasury, which instructions may impose conditions to the destination and sale of the same, and the investment of the proceeds of the same, or a portion thereof, in military or other supplies for the public service, which instructions such officers shall be bound to obey; and if any action or suit shall be brought against any such officer or officers, or their agents, he or they may plead the general issue, and upon proof of a compliance with the provisions of this act, or of the regulations and instructions of the President, he or they shall be absolved from all responsibility therefor; and any person aggrieved by any of the acts of any of the officers or agents aforesaid, may file his petition before the district court of the district in which such officer or agent resides, and after due notice to him, and to the district attorney, the said court may proceed summarily to hear and determine thereupon as law and justice may require, and the judgment of the said court, and the reasons therefor, shall be filed among the records of the court. And in case any release shall be granted, the judge may impose such conditions as to giving bond and security as may, in his opinion, be necessary to secure this act from violation, and in case of refusal, may impose double or treble costs upon the petitioner, if the circumstances warrant it: Provided, That nothing in this act shall be construed to prohibit the Confederate States, or any of them, from exporting any of the articles herein enumerated, on their own account.

Exclusive jurisdiction conferred upon the district court of all actions that may arise under this act for the recovery of fines, forfeitures and penalties.

SEC. 6. That exclusive jurisdiction is conferred upon the district courts of the Confederate States, of all suits or actions that may arise under this act in behalf of the Confederate States, its officers and agents, for the recovery of all fines, penalties and forfeitures, imposed in the same, by indictment, information or action, according to the practice of the court, and the distribution of the penalties and fines shall be made, under and according

Page 183

to the laws now in force for violation of the revenue acts; and all laws for the mitigation and remittance of penalties and forfeitures, shall be applied in similar cases.

President may employ military or naval force to prevent violations of this act.

SEC. 7. That it shall be lawful for the President, or such officers as he may designate, to employ any portion of the military or naval forces of the Confederacy, or of the militia, to prevent the illegal departure of any ship, vessel or other water craft, or for detaining, taking possession of, and keeping in custody the same, or any wagon, cart, or other vehicle hereinbefore mentioned, their teams and drivers, and their products aforesaid, and to suppress and disperse any assembly of persons who may resist the execution of this act, or oppose the fulfillment, by the officers, of the duties imposed by the same.

When this act to expire.

SEC. 8. That this act shall expire on the day of the ratification of a treaty of peace with the United States.

APPROVED February 6, 1864.

CHAP. XXV.--An Act to prohibit dealing in the paper currency of the enemy.

Feb. 6, 1864.

Dealing in the paper currency of the United States prohibited.

Proviso.

The Congress of the Confederate States of America do enact, That no broker, banker, or dealer in exchange, or person concerned in trade as a merchant, or vender of merchandise of any description, or any other person, except within the lines of the enemy, shall buy, sell, take, circulate, or in any manner trade in any paper currency of the United States: Provided, That the purchase of postage stamps shall not be considered a violation of this act.

Prosecution of offender.

Forfeiture, fine and imprisonment.

Judges to give this act specially in charge to grand juries.

SEC. 2. That any person violating the provisions of this act shall be subject to indictment and prosecution in the Confederate Court holden for the district in which the offence was committed, and shall, upon conviction, forfeit the amount so bought, sold, circulated or used, or a sum equal thereto; and shall be, moreover, subject to a fine of not more than twenty thousand dollars nor less than five hundred, and be imprisoned not less than three months, nor more than three years, at the discretion of said court; and it shall be the duty of the judges of the several Confederate Courts to give this act specially in charge to the grand jury.

Act not to apply to persons acting in behalf of Gov't.

SEC. 3. That this act shall not be construed to apply to any person acting in behalf of the Government of the Confederate States, by special authority from the President, or any of the heads of Departments.

APPROVED February 6, 1864.

CHAP. XXVI.--An Act to authorize Commanders of Corps and Departments to detail

Field Officers as members of military courts, under certain circumstances.

Feb. 6, 1864.

Detail of field officers as members of military courts.

The Congress of the Confederate States of America do enact, That commanders of corps and departments be, and they are hereby, authorized to detail field officers as members of military courts, whenever any of the judges of said courts shall be disqualified by consanguinity or affinity, or unable, from sickness or other unavoidable cause, to attend said courts.

APPROVED February 6, 1864.

Page 184

CHAP. XXVII.--An Act to authorize the appointment of an agent of the Post-Office Department, and such clerks as may be necessary to carry on the postal sereice in the States west of the Mississippi river.

Feb. 10, 1863.

Appointment of agent of the Post-Office Department.

Where to keep his office.

Salary.

The Congress of the Confederate States of America do enact, That there shall be appointed by the President, by and with the advice and consent of the Senate, an agent of the Post-Office Department, who shall keep his office at such place in the States west of the Mississippi river as shall be designated by the Postmaster General, who shall receive for his services a salary of four thousand dollars per annum.

His powers and duties.

Transfer of funds from the office of the agent of Treas. Dept. west of Miss. river, to postmasters.